Matt Frazier

Founder and CEO, Jones Street Investment Partners

Age: 45

Industry experience: 20 years

Jones Street Investment Partners looks for undervalued acquisitions of multifamily rental properties and select development opportunities in the multifamily sector throughout New England. Matt Frazier founded the firm in 2014 after a career in the local banking industry. In 2021, its busiest year yet, Jones Street completed over $850 million in transactions in the acquisition and sale of 10 properties totaling over 2,600 apartments. In Massachusetts, Jones Street currently owns the East Main apartments in Norton, The Meadows in Chelmsford, Webster Village in Hanover, The Union House in Framingham, Ashford Crossing in Shrewsbury, and is developing apartment complexes at 35 Braintree St. in Allston and 21 East in North Attleborough.

Q: What’s the history of Jones Street Investment Partners and its business model?

A: I started my finance career doing loan workouts for FleetBoston back in the aftermath of the dotcom bubble, and transitioned into Banc Boston Capital and then into commercial real estate. We started Jones Street in 2014 and made our first investment in New Hampshire a while later and continued to grow through additional acquisitions. We now have $1.3 billion under management, and we self-manage our portfolio. Our business is specific to multifamily and currently exclusively in New England and upstate New York. Our investment strategy focuses on value. We tend not to define risk as core or value-add; we think of ourselves as value investors in the mold of [economist] Benjamin Graham.

Q: How do you identify undervalued properties?

A: We can find value in a couple of different ways. We target markets that have core rental demand without core investor demand, meaning we are going to growing rental markets, but we’re not competing on the buy side with a lot of additional capital like we’d be in the urban core.

Q: What are the effects of COVID on that segment of the multifamily market?

A: It definitely has increased investment activity in our market, and that’s made our job a little bit harder. It’s also validating our strategy since 2014. A lot of it is for a good reason. There was a de-densification and lifestyles have changed with home work. It’s allowed people to move out of the urban core to the suburbs. Like everything else, we expect some aspects will remain permanent. I do think more flexible work schedules are going to stay.

Q: What characteristics do you look for in evaluating specific properties?

A: With respect to size, we don’t do a lot lower than 100 units, because we self-manage. With respect to age or asset quality, we’re generally agnostic as long as we can find value. We’ve owned buildings from the 1940s and brand-new assets. Today we’re generally targeting higher-quality assets in the high-quality locations, and they’ve done well during the pandemic.

Q: How do you assess new development opportunities of your own?

A: Our first project was located at 21 East St. in North Attleboro. That is essentially complete. We’re waiting for the final certificate of occupancy on the building, and we’ve currently 55 percent leased. We’re looking at development, though our development projects generally have some sort of hook, such as an attractive land basis or tax strategy. We’re not buying fully marketed land. In New England we’re land-constrained, and entitlements take time. It’s made even more difficult, but done successfully, developers can enjoy good rental demand because we are a supply-constrained market. But development is a smaller part of our business. The main part is acquiring stabilized assets.

Q: What’s the timeline for your development of 35 Braintree St. in Allston?

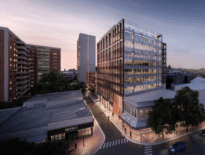

A: We are developing 149 luxury apartments just east of Boston Landing adjacent to the Mass Pike. The property will have a mix of studios, one- through three-bedroom units and three artist live-work units, a makerspace and a dedicated art gallery. Our connection to the art community is interesting. I serve on the directors of Midway Studios, and we’ve been engaged with the arts community and have looked at that as the way to be in a symbiotic partnership to support affordable housing. We are fully entitled and began demolition [in December]. We’re targeting a completion date in summer of 2023.

Q: What is your outlook for the sector in 2022?

A: I think that investor interest in multifamily, particularly in the suburban secondary market, is continuing to remain very strong. A lot of that is supported by positive fundamentals and strong rental demand. I’ve had investors ask me if I feel it’s frothy and my response is, it’s actually rational. A lot of capital that was previously earmarked for office or hospitality or retail has been redeployed, and industrial and multifamily assets have received the bulk of that reallocation.

Frazier’s Five Favorite Movies:

- Almost Famous

- 12 Monkeys

- Goodfellas

- Lord of the Rings: Fellowship of the Ring

- Caddyshack

|

|