With apartment rents rising by double-digits in one of Boston’s last pockets of affordability, Boston officials singled out 250 acres along the MBTA Orange Line corridor in Roxbury and Jamaica Plain for an experiment in city planning.

Developers who set aside higher percentages of affordable units than the 13 percent citywide minimum could get density bonuses for additional square footage designed to make the economics of projects work, encouraging production of more market-rate and income-restricted units alike.

Two years after the Boston Planning and Development Agency approved the Plan JP/Rox guidelines while police removed protesters demanding more aggressive affordability requirements, the jury is still out on the neighborhood impact. The program has neither sparked a massive building boom nor drastic changes in how private and nonprofit developers are designing and financing projects, housing industry executives say.

Part of the reason is that the affordability requirements begin to cancel out the density benefits as buildings get taller.

“There’s kind of a belief that the JP/Rox study has greatly increased the availability of density, where in actuality it’s still pretty much capped at three to four stories,” said Clifford Kensington, acquisitions manager at Brookline-based City Realty.

And the guidelines approved by the BPDA in March 2017 remain just that: without an amendment to the zoning code, many developers still need variances from the zoning board of appeals to gain final approvals.

Activists disrupted a Boston Planning and Development Agency reception in 2016 to protest new zoning guidelines for the Jamaica Plain and Roxbury neighborhoods. Photo by Steve Adams | Banker & Tradesman Staff

Parcels Go for Large Sums

The study area has seen a development pipeline of more than 2,000 units in recent years, including large projects such as Criterion Development Partners’ 252-unit Residences at Forest Hills, under construction at a 2.1-acre former parking lot across from the Orange Line’s southern terminus.

More than 11 acres of privately owned industrial parcels, parking lots and vacant lots lie within the study area, according to a BPDA report, providing fertile opportunities for redevelopment into housing.

“The huge money that developers are spending to buy previously abandoned parcels or old pieces of land that have been used for industrial uses for the last 50 to 100 years, that’s going to continue unabated,” said Richard Thal, executive director of the Jamaica Plain Neighborhood Development Corp. “People are paying huge quantities of money, apparently on the belief they can somehow charge rents that are going to be astronomical to justify that investment.”

With average neighborhood rents rising 9.25 percent to $2,050 from 2014 to 2016, and renters comprising 70 percent of the roughly 2,600 households in the study area, developments containing significant income-restricted units for households earning under $50,000 could slow displacement, the BPDA study said.

The final guidelines were designed to balance between developers’ financial targets, some residents’ demands for lower building heights near established neighborhoods and community activists’ calls for up to 100 percent affordability requirements. The final version set a goal of doubling the area’s 1,000 units of income-restricted housing, including approval of higher floor area ratios for projects that provide more than 13 percent affordable units.

Density Bonuses Have Limited Effectiveness

Data on the percentage of affordable units permitted in the neighborhood was not available from the BPDA, whose senior planner on the JP/Rox study left the agency several months ago. But a 23-unit complex approved this month at 197-201 Green St. in Jamaica Plain is representative of the types of projects that are financially feasible in the study area, the developer said.

City Realty plans to demolish a single-family home to build a 4-story, 20,480-square-foot apartment building. Three artist lofts will be set aside for households earning a maximum of 70 percent of area median income, and another at 50 percent of AMI.

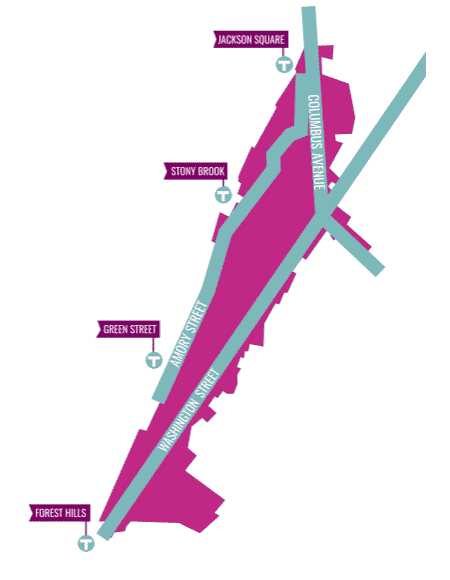

The Boston Planning and Development Agency’s 250-acre JP/Rox Plan was intended to balance competing interests as development spilled across the Orange Line tracks into the border area between Jamaica Plain and into Roxbury.

Providing more affordable units, City Realty’s Kensington said, wouldn’t have been economically feasible.

“It doesn’t make sense to build above a certain density, because you get into affordability levels above what you’d see for Chapter 40B,” he said, referring to the state’s affordable housing zoning law which requires a 20 percent minimum.

Market rate units will range from approximately $1,800 studios to two-bedroom units in the low $3,000 range, he said.

Community Developers Face Challenges

Historically a source of new affordable and mixed-income housing construction, nonprofit community development corporations are moving ahead with projects in the JP/Rox Plan corridor, but continue to face their own set of typical financing challenges.

A partnership between developers Urban Edge, The Community Builders and Jamaica Plain Neighborhood Development Corp. is seeking state and federal low-income tax credits to help finance construction of 350 apartments in three buildings at 125 Amory St. The project would include 135 income-restricted units, most reserved for households earning up to 60 and 70 percent of AMI.

An initial phase of the project, renovation of 199 Boston Housing Authority apartments, broke ground this month. The new construction would be built on vacant land ground-leased from the BHA.

Urban Edge, which will own one of the new buildings, was turned down in its initial application for tax credits, setting back the project timeline, said Marty Jones, Urban Edge’s interim CEO. In the meantime, rents of privately owned apartments in the neighborhood spike with each change of ownership.

“We see a lot of anecdotal evidence that when properties are bought before we can get to them [to acquire], rents do go up,” Jones said.

The Community Builders of Boston is partnering with the Pine Street Inn on a proposal that would bring 225 income-restricted units to 3368 Washington St. in Jamaica Plain, including 140 units with support services for former homeless people. The project designed by Rode Architects would be built on a property that currently houses the homeless shelter’s offices and warehouse.

A project notification form will be filed this spring, said Andy Waxman, regional vice president for The Community Builders, with designs that comply with the JP/Rox Plan guidelines, but will require zoning variances.

The plan was “quite controversial and there is not a full consensus about it,” Waxman said. “This is where the BPDA ended up, so we’re definitely designing within the spirit of those guidelines. We’re not assuming this is as-of right and forgetting the community.”

|

|