Twelve of Boston’s biggest housing lenders will offer homeowner borrowers in the city three months or more of deferred mortgage payments if they can demonstrate they have been financially impacted by the coronavirus crisis.

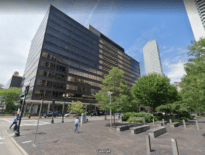

Boston Mayor Marty Walsh announced the measure in a Thursday afternoon press conference outside City Hall. The city estimates it has 94,000 homeowners, not all of whom have mortgages.

“No person should have to worry about losing their home right now. During these times of global uncertainty, homeowners and renters in Boston can be certain that we are doing everything we can to help ease the burden brought on by this pandemic and give them much-needed flexibility,” Walsh said. “I want to thank our lender partners who have stepped up to the plate to meet the needs of our residents during this time, and I encourage others to follow suit. Now more than ever, we have to work together to make sure that we can keep people in their homes.”

The deferments could last longer than three months, if needed. In addition, the lenders have committed not to charge late fees or report non-payments to the credit bureaus. Homeowners will not be required to pay back the deferred mortgage payments in a lump sum, but will instead be able to work with lenders on an affordable repayment plan.

The lenders involved in the voluntary program are: Bank of America, Boston Private, Cambridge Trust Company, Century Bank, Citizens Bank, City of Boston Credit Union, Dedham Savings Bank, Eastern Bank, Mortgage Network, Inc., Prime Lending, Salem Five Bank and Santander Bank.

Walsh’s office said the lenders have also agreed to the goal of approving deferments within 21 days of application and with only “essential paperwork” needed from the homeowner. The lenders will not report this deferment as a bad loan, nor report it to the credit bureaus as being a late loan. They will not charge late fees on the late loan payments or deferments. Once the deferment period is complete, the homeowner is not required to pay the total deferment/forbearance amount in a lump sum.

Thanks to the CARES Act and prior actions by the FHFA, borrowers are able to request forbearance on federally backed mortgages, including those backed by Fannie Mae, Freddie Mac, the Veterans Affairs and the Federal Housing Authority.

“Bank of America is pleased to work with the City of Boston on a goal we share: to help the clients we serve get the assistance and support they need to get through this crisis,” Bank of America Massachusetts President Miceal Chamberlain said in a statement.

“Boston Private is pleased to expand our partnership with Mayor Walsh and the Department of Neighborhood Development to help our home mortgage borrowers who have been dramatically affected by COVID-19,” Boston Private CEO Anthony DeChellis said in a statement. “These are extraordinary times and we are proud to work together with the City on this coordinated response to ensure homeowners are able to stay in their homes.”

|

|