The common play for investors has long been to purchase shares in banks that are prime takeover candidates, hope they get sold and then collect a nice premium. But Sandler O’Neill, a firm that invests in banks in Massachusetts and nationwide, believes there’s a better approach.

The investment banking firm in a recent industry note recommended buying stock not in the banks that may be sold, but rather in the banks making the purchases, or the most acquisitive banks.

An analysis Sandler did of the stock price of the 21 most acquisitive banks between 2012 and 2017, none of which were in Massachusetts, showed an average return of 148 percent. Takeover premiums have been consistent in the 30 percent range over time, Sandler noted.

While investing in takeover candidates or acquisitive banks can both reap significant rewards, they are ultimately two entirely different approaches, said Jim Jones, founder, president and CEO of First Wellesley Consulting Group.

“I would much rather be on the side of banks that have a clear acquisition strategy as opposed to trying to predict whether a bank will be acquired in a certain year,” he told Banker & Tradesman. “It’s a value play in a company that is well capitalized, has grown and is clear they have a good management team and business model. The other person is the person who wants to speculate.”

“I would much rather be on the side of banks that have a clear acquisition strategy as opposed to trying to predict whether a bank will be acquired in a certain year,” he told Banker & Tradesman. “It’s a value play in a company that is well capitalized, has grown and is clear they have a good management team and business model. The other person is the person who wants to speculate.”

According to Sandler’s industry note, there are 5,787 banks in the U.S. and about 2.5 percent sell during an average year.

“Figuring out which banks are likely to sell is often driven by factors that can’t be gleaned from the outside looking inward,” the note said. “This exercise is complicated by the fact that many of the logical takeover candidates are not great standalone investments. And if the company does not sell, investors could be left holding the bag.”

Massachusetts Market

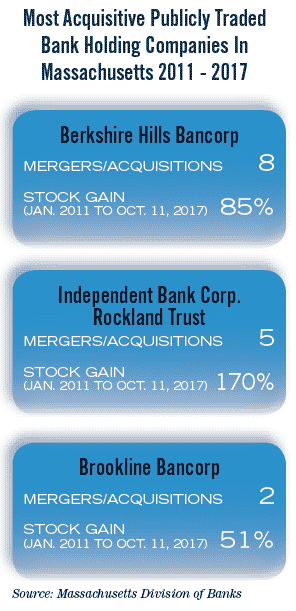

Although the study was of banks in other parts of the country, the theory from Sandler does appear to hold true in Massachusetts.

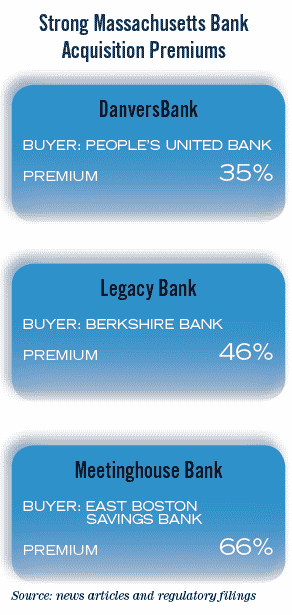

There were 18 mergers and acquisitions by publicly traded banks in the commonwealth between February 2011 and October 2017, many of which produced strong premiums, according to data from the Massachusetts Division of Banks.

For instance, the parent company of Bridgeport, Connecticut-based People’s United Bank in 2011 bought the parent company of DanversBank for $23 per share, 35 percent above the stock’s closing price on the day the deal was announced.

The parent company of Meetinghouse Bank, which was acquired by East Boston Savings Bank in an all cash deal this year, saw a 66 percent premium on the stock price.

The premium on these deals would have been even higher for those shareholders who bought stock right around the time the company announced an initial public offering, or got discounted stock because they were initially depositors at the bank before it went public.

But overall, the most acquisitive community banks in Massachusetts appear to have done even better.

The parent company of Berkshire Bank, which has made eight merger and acquisition deals between 2011 and 2017, has seen its stock go from roughly $21 to roughly $39 between January 2011 and Oct. 11 of this year, an 85 percent gain.

The parent company of Rockland Trust, which has made five merger and acquisition deals between 2011 and 2017, has seen its stock in the same time period go from roughly $27 to more than $73 as of Oct. 11 of this year, a 170 percent gain.

Predictability Issues

Investors can assume that once a bank makes one acquisition or merger, there is a good chance it will make another.

Investors can assume that once a bank makes one acquisition or merger, there is a good chance it will make another.

“Generally speaking, the better banks become at identifying institutions [to purchase], the better they become at doing it,” said Larry Spaccasi, a partner at Luse Gorman, a Washington, D.C. firm that has represented Massachusetts banks in mergers and acquisitions. “Regulators see banks get better at acquisitions, and once they do one or two, it becomes easier to get regulatory approvals.”

Banks are also much blunter when they want to make acquisitions as opposed to when they want to sell.

For instance, many assumed Belmont Savings Bank would be acquired when it became eligible in 2014, and while it still could be one day, the bank has remained independent and experienced tremendous growth.

On the other hand, Christopher Oddleifson, CEO of Rockland Trust and its parent company, Independent Bank Corp., has been very clear over the years of his intention to make acquisitions.

After purchasing Central Bank in Somerville in 2012, he said the company would look to make more acquisitions and the bank has done just that, including fulfilling the company’s longstanding promise to get into Boston when it purchased People’s Federal Savings Bank in 2015.

According to various media outlets, Oddleifson said earlier this year he is interested in making another large acquisition, potentially as high as the $3 billion to $4 billion asset range.

“I think there are some really good acquisitive banks and good earners that can integrate other banks and do well,” said Spaccasi.

|

|