Tishman Speyer’s Residences at Pier Four condominium project which opens this May in the Seaport District has average prices topping $2,100 per square foot for units under agreement.

Two ultra-high-end condominium developments scheduled to open this spring in Back Bay and the Seaport District will likely set records while asking prices for Boston condos continue to rise across a broad swath of neighborhoods and property types.

The market remains firmly tilted in sellers’ favor, but is beginning to show signs of a correction, according to a research report by The Collaborative Cos. brokerage in Boston. The typical condo listing in the Boston urban core – spanning from the Fenway to the waterfront – spent 47 days on the market in 2018, an increase of five days from the previous year.

“For new projects, we haven’t seen price points dissipate,” said Sue Hawkes, managing director of The Collaborative Cos. “What we’ve seen is a little slower market. When we’re working on a pro forma, we’re going to project a longer sellout than we were a year or two ago. So that in itself is a bit of a correction and an adjustment.”

While luxury projects such as One Dalton and Pier Four will attract the most notice, sales volume in the over-$2 million range started to decline in the fourth quarter. Gone are the days when projects such as Millennium Tower and Slip65 in East Boston sold out prior to completion. Hawkes’ firm is representing developer Related Beal in the marketing of its 157-unit Lovejoy Wharf condos in the West End, which had 92 units available at year’s end.

While luxury projects such as One Dalton and Pier Four will attract the most notice, sales volume in the over-$2 million range started to decline in the fourth quarter. Gone are the days when projects such as Millennium Tower and Slip65 in East Boston sold out prior to completion. Hawkes’ firm is representing developer Related Beal in the marketing of its 157-unit Lovejoy Wharf condos in the West End, which had 92 units available at year’s end.

And approximately 1,500 condos priced above $1,450 per square foot are scheduled to be on the market within 12 months, according to the report, which represents more than three years of inventory based upon recent absorption rates.

Many Units in the Offing

One Dalton, developer Carpenter & Co.’s slender, 61-story skyscraper in Back Bay, is expected to open in late April, followed in May by Tishman Speyer’s Residences at Pier Four in the Seaport. The two ultra-luxury projects are testing the upper price ranges, with two penthouses at One Dalton under agreement in the $40 million range, and estimated prices per square foot expected to exceed $2,500.

At the 106-unit Residences at Pier Four, “more units are sold than not sold” at average prices above $2,100 per square foot, said Janice Dumont, CEO at Boston-based brokerage Advisors Living. Residences feature 9-foot ceilings and private balconies, while penthouses will have outdoor kitchen-equipped roof decks ranging from 500 to 2,500 square feet.

One Dalton has not announced presale activity or average prices.

Identify New Prospects with Targeted Marketing Lists

Property owners are a prime target market for insurance, banks, real estate, home improvement, investment, and most retail and home service businesses. With information on more than 130 million households – encompassing 94% of the U.S. population – we invite you to learn more about how The Warren Group’s Targeted Marketing Lists can generate more quality business leads to develop your business.

The St. Regis Residences at 150 Seaport Boulevard will contain 114 condominiums along with a two-level signature restaurant and three levels of underground parking.

Cottonwood Group’s EchelonSeaport, which includes 447 condos, is positioned for a wide range of prices ranging from approximately 40 studios starting at $700,000 to $5 million penthouses.

“It’s quite a large project, so they’re trying to spread the wealth and diversify their risk and that will change the whole personality of the building,” said Timothy Marsh, vice president at Back Bay brokerage Marsh Properties. “But it was probably a smart strategy. It’s no secret that we’re in the fourth quarter of the market in my opinion, because we’re going to start to run into some absorption problems.”

East Boston waterfront developments are positioning themselves as a lower-priced alternative to the Seaport District. Lendlease’s Slip45 at Clippership Wharf is listing prices ranging from $600,000 to $1.5 million. The previous condo phase, Slip65, sold out ahead of completion at average prices of nearly $900 per square foot. The 114 units at Slip45 will hit the market this spring.

New Inventory Not Moderating Prices

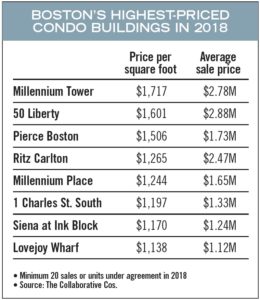

Of the eight properties with the highest average prices per square foot in 2018, all but two have been completed since 2016. That reflects buyers’ preference for the newest properties with large amenity spaces and personal assistant-type concierge services, brokers say.

But the additional inventory isn’t moderating price increases in the high-end market, and resales of condos in previous-generation luxury buildings seem to be reflecting the higher price tiers at the latest projects.

Steve Adams

There’s no indication that the new luxury towers are competing directly with traditional luxury products such as Back Bay rowhouses and townhouses, and sales activity in that segment remains robust, Marsh said. Since the beginning of the year, there have been 10 condo closings for $5 million or more, compared with six during the same period in 2018, in the firm’s market area ranging from Chestnut Hill to the Seaport.

“What’s interesting is I expected to virtually all of the sales in the doorman buildings in those high-priced categories, but it’s been a mix,” Marsh said. “In this price range, there’s not a lot of crossover, and that’s good to see because you never want to see the market skew to one particular property type.”

This article has been updated to correct the number of units available at Lovejoy Wharf at the end of 2018.

|

|