The maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac will increase in 2020. The Federal Housing Finance Agency announced that the loan limit for one-unit properties will increase from $484,350 in 2019 to $510,400 in 2020, a 5.38 percent increase.

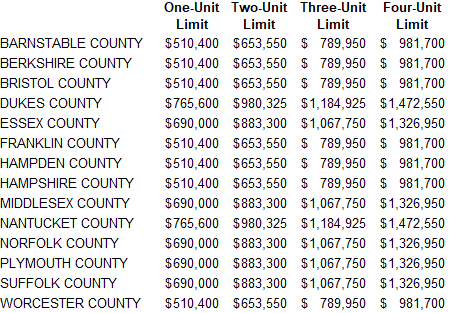

Because of median home values, several counties in eastern Massachusetts will have higher limits.

The FHFA adjusts the conforming loan limit annually to reflect the change in the average U.S. home price, as required by the Housing and Economic Recovery Act (HERA). Conforming loan limits had remained stagnant for a decade, but since 2016, the limit has increased each year.

Using its third quarter 2019 House Price Index report, the FHFA calculated the increase based on estimates of the average U.S. home value over the last four quarters. According to FHFA’s seasonally adjusted data, house prices increased 5.38 percent between the third quarters of 2018 and 2019. The baseline maximum conforming loan limit in 2020 will increase by the same percentage.

Conforming loans in half of Massachusetts’ counties will be subject to this $510,400 limit. The other half will have higher maximum limits because 115 percent of the local median home value exceeds the baseline limit. Many high-cost areas in the U.S. saw median home values rise in 2019, driving up the maximum loan limits in these areas, according to the FHFA.

HERA limits the maximum conforming loan ceiling to 150 percent of the baseline. Both Dukes and Nantucket counties will qualify for the maximum limit of $765,600 on one-unit properties. Counties with a conforming loan limit of $690,000 are Essex, Middlesex, Norfolk, Plymouth and Suffolk.

Massachusetts 2020 conforming loan limits by county. Source: Federal Housing Finance Agency

A wider pool of people will now qualify for conforming mortgages, especially benefiting first-time homebuyers. Conforming mortgages financed by government-sponsored entities and the FHFA are the most lenient, allowing eligible first-time homebuyers to put down as little as 3 to 5 percent in some cases. Jumbo loans, on the other hand, require borrowers to have higher FICO scores and larger down payments, and also come with asset and reserve requirements.

The higher conforming limit could also encourage more homeowners to refinance if interest rates remain low.

Year-to-date, there have been 49,524 single-family home sales – a 1.4 percent decrease from the first ten months of 2018 – with a median sale price of $400,000 – a 3.9 percent increase on the same basis according to The Warren Group, publisher of Banker & Tradesman.

|

|