Millennium Partners earlier this year received permission to reduce the count of condo units – now apartments – and the size of one of its proposed Winthrop Center towers.

Luxury apartment towers from Boston to San Francisco are doling out free rent like there’s no tomorrow in the wake of the coronavirus epidemic and the severe downturn it has triggered.

Now, in a troubling sign for the commercial real estate market, the owners of office towers and buildings across Boston are taking a page from the luxury rental playbook and offering enticements to prospective tenants.

The “vast majority” of office landlords are offering some sort of concession, whether it be free rent, a break on tenant improvement expenses or an outright reduction in rent, said Aaron Jodka, managing director for research and client services for Colliers International.

“The pandemic … is massively disrupting business and the recession has been sharp, and job losses are more than anything we could have imagined,” Jodka said. “It’s only logical you would see a change in incentives.”

Free rent and bigger subsidies for office fit-outs have become favored tactics on the part of building owners as they seek to win over a shrinking number of companies looking for new space. In some cases, office landlords are picking up the entire tab for office fit-out work in “turnkey deals.”

None of these sweeteners show up when average office rents are calculated, masking the true extent of just how distressed the Boston office market is as we head into a winter of dire economic uncertainty and pandemic turmoil.

These offers, together with the mountain of empty space office landlords are scrambling to fill, may have a big impact on the city’s skyline over the next decade.

A bevy of new proposed office towers was poised to move forward in Boston at the end of 2019, the biggest surge in office development in decades amid a boom that had been dominated by luxury condo and apartment high-rises.

Texas developer Hines was finally moving ahead with its decades-old plan to build a 51-story office tower over South Station, while around the corner Millennium Partners was plunging ahead with its own plans for 691-foot-high office and residential tower at Winthrop Square.

Meanwhile, over at Post Office Square, owners of the One Post Office Square tower were nearing the finish line with their sweeping $250 million renovation.

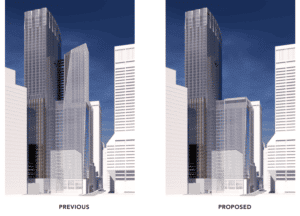

But since the pandemic began, there have not been any new lease announcements from the developers of these and other proposed office towers in Boston. In fact, Millennium has had to significantly rejigger its plans and is looking for financing to begin construction in earnest.

Scott Van Voorhis

Sublease Space Availability Spikes

Rents for top-shelf Class A space were unchanged in the third quarter, according to Colliers, while rents on older, less prestigious Class B buildings have slipped a mere 1 percent, at least on paper.

A significantly smaller number of landlords are quietly cutting office space deals with companies for rents below the advertised price, sometimes as much as 10 percent below. But they are careful not to lower the official asking price.

“When they are quoting the building (to potential tenants) they are not saying its 10 percent lower,” Jodka said. “The market isn’t what it was nine months ago, when you had there were three other tenants waiting behind them and you could potentially play hardball.”

Still, it’s probably not accurate to say there’s no hardball being played. It’s just who is playing it that has changed – bargain-hunting financial services firms and other companies that have the leverage and are not afraid to use it.

Some large office tenants are wrangling the kind of free rent deals that luxury apartment dwellers, no matter how well heeled, can probably only dream of. In some cases, big companies are effectively securing almost a year’s worth of free rent, such as an agreement for one month free each year over a 10-year lease.

But hardball or no, it’s increasingly hard for real estate investment firms and other landlords large and small to hold the line in a downtown office market suddenly awash in empty space.

Boston was hit with more than 1.3 million in negative absorption in the third quarter, according to Colliers International. That’s enough empty corporate suites to fill most of the Hancock Tower.

The wave of empty offices hitting the market drove the vacancy rate up to 12.6 percent and included 600,000 square feet of sublease space as companies looked to dump no longer needed offices, whether from layoffs or staff now working from home.

More sublease space has hit the market over the past two quarters – roughly since the start of the pandemic – than hit the market in the early 2000s after the tech bubble burst, Colliers reports.

Tough times have once again returned to the Boston office market. And from the look of things, the big real estate firms that control the Hub’s office market won’t be pulling their offers of free rent and turnkey deals anytime soon.

Scott Van Voorhis is Banker & Tradesman’s columnist; opinions expressed are his own. He may be reached at sbvanvoorhis@hotmail.com.

|

|