From system problems to unclear and changing guidelines, community banks faced multiple challenges throughout the early days and weeks of the Paycheck Protection Program, all while themselves adjusting to the effects of the pandemic and economic shutdown.

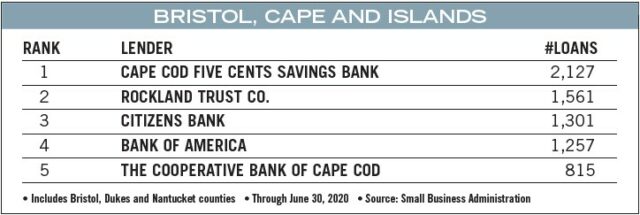

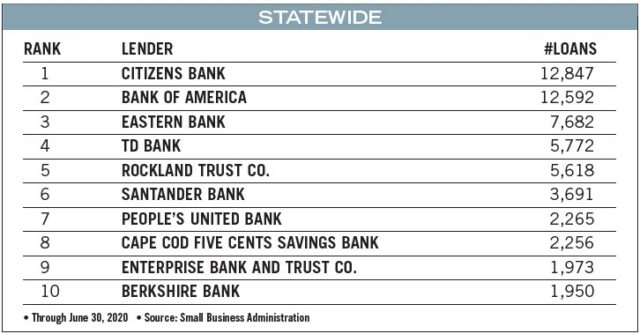

A key to confronting the challenges was understanding the issue at hand, said Bert Talerman, co-president of Cape Cod Five, one of the top PPP lenders in Massachusetts.

“It was a unique situation, unique levels of volume,” Talerman said. “And being able to take that unique approach to it and not view it in terms of a traditional commercial lending lens is really one key to us being able to have achieved here the level of support for customers.”

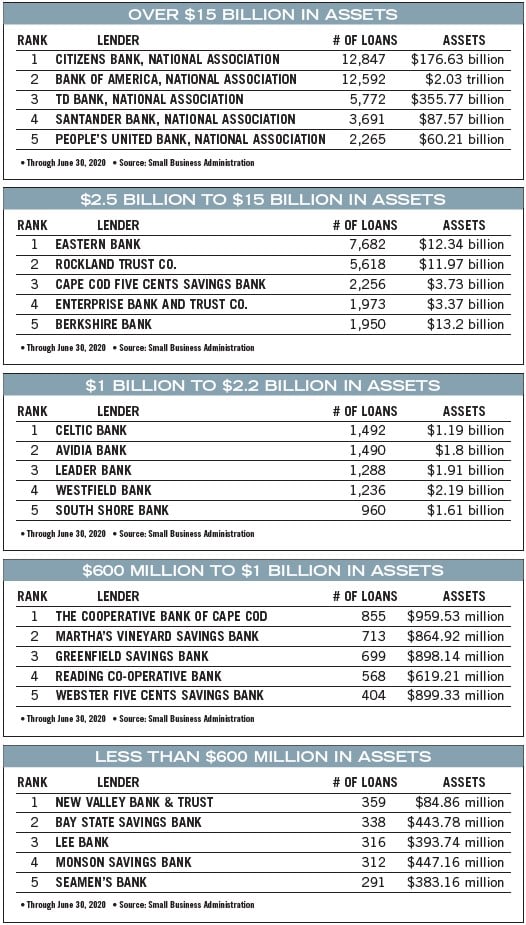

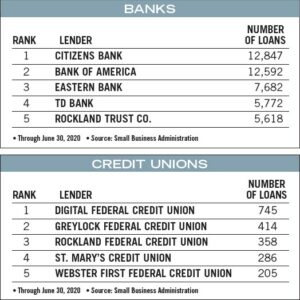

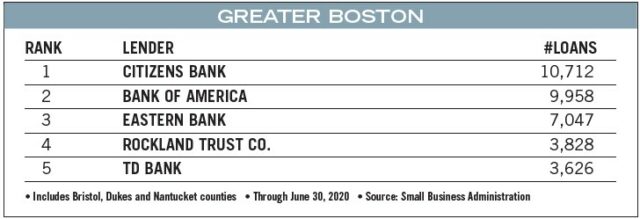

Massachusetts lenders together through June 30 processed 113,000 PPP loans totaling more than $14.3 billion. With Congress authorizing another round of funding through Aug. 8, the state’s lenders worked on more than 3,200 loans in July.

To process as many loans during the PPP’s first few weeks as they would typically do in a year – if not several years – community banks turned to all areas of the bank, while focusing on the small business customers behind the program.

Motivated to Help

Motivated to Help

Though banks will receive fees, as well as interest on loans remaining on the books, this income did not justify participating in the program, said James Dunphy, president and CEO of Weymouth-based South Shore Bank, among the top lenders among banks with $1 billion to $2.5 billion in assets.

Instead, the program’s underlying purpose helped motivate South Shore to respond as part of the initiative.

“We stepped back to look at it, and we’re saving jobs, we’re doing our part to help the economy get through this,” Dunphy said. “That’s what we focused in on is jobs and saving small businesses, so that they could get this lifeline, and I think that helped rally our team.”

South Shore Bank did not have an automated process at the outset for accepting loan applications. While burdensome, the manual process made it easier for staff to adapt to the frequent changes the U.S. Small Business Administration and Treasury Department made throughout the program, Dunphy said, especially during the PPP’s early stages.

More than half of the bank’s personnel worked on the program. Those with day care issues often worked nights and weekends to get through applications. Among the challenges the bank faced included finding laptops for staff members to use while working remotely and needing to expand the bank’s network capabilities to support the process.

South Shore closed as many loans in about two months as it had done in the past two-and-a-half years. The bank continues to accept applications and has processed about 1,000 loans worth $130 million. About 14,000 jobs were saved through the process.

Digital Change Sped Up

The bank did end up developing a digital process for the PPP, and Dunphy added that the pandemic has accelerated by about five years the bank’s move toward digital processes and communications. He said both customers and bank personnel have become more comfortable with operating in a digital environment.

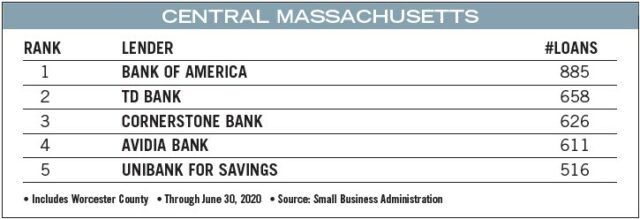

Another of the top lenders among banks with $1 billion to $2.5 billion in assets and among all lenders in Worcester County, Avidia Bank has continued to accept applications throughout the summer, processing in total more than 1,600 loans totaling around $190 million.

Avidia had a technology partnership and infrastructure that let the bank set up an automated application process from the outset, said Rita Janeiro, senior vice president for community banking who led the bank’s PPP initiative. Pulling the process together, in what Janeiro described as a scramble, meant using people from all areas of the bank to work on both the digital solution for the customer and the backend process for the bank.

“Now it’s as if we’ve been doing it forever, because we feel we’ve perfected it to where it’s pretty easy for the customer,” Janeiro said.

A silver lining to the pandemic, Dunphy said, is that departments that normally would not work together have been helping others and learning what other groups do.

“Quite a few people pleasantly surprised us,” Dunphy said. “Some people that we didn’t necessarily expect really rose to the occasion, really became stars in the organization, and learned to work with others – that was a real bright spot.”

Rewarding Challenge

Avidia has already created a digital process for the forgiveness phase of the PPP, which begins Aug. 10, as has Cape Cod Five.

Matt Burke, Cape Cod Five’s co-president with Talerman, said the bank has worked with a technology partner to create online portals both for PPP applications and for the forgiveness process. Though the bank is ready for forgiveness, Burke would like to see Congress simplify the process for smaller loans to take the burden off banks and small businesses.

Diane McLauglin

Cape Cod Five has processed 2,300 loans, including some in July, and recently exceeded $200 million in lending. Burke said more than 22,000 jobs were saved with the program.

Resources were reallocated throughout the bank to help with the PPP, Burke said, and the bank had staff working around the clock for much of the first two months.

“It has been a challenge,” Talerman said. “In these very challenging times, I think it is fair to say that the PPP program, while not ideal for all businesses – and there is lots of well-documented frustration around that – for a significant amount of customers, this has been a lifeline and has been extremely helpful for them.”

|

|