Four community banks have joined a new program that offers down payment assistance and discounted mortgage rates to Boston residents who are first-time homebuyers.

It is hoped the program will give city families and residents who earn area median income or below a leg up on all-cash buyers in the city’s expensive housing market and comes at a time city officials are being urged to do more to close gaps between Bostonians of color and their white peers.

Boston Private, Cambridge Trust Co., Citizens Bank and Santander Bank will offer the ONE+Boston program created by the city of Boston and the Massachusetts Housing Partnership based on MHP’s existing ONE Mortgage product. Boston Private and Santander are currently offering the ONE+Mortgage product; Cambridge Trust will join on July 1 and Citizens later this summer, the city said in a statement.

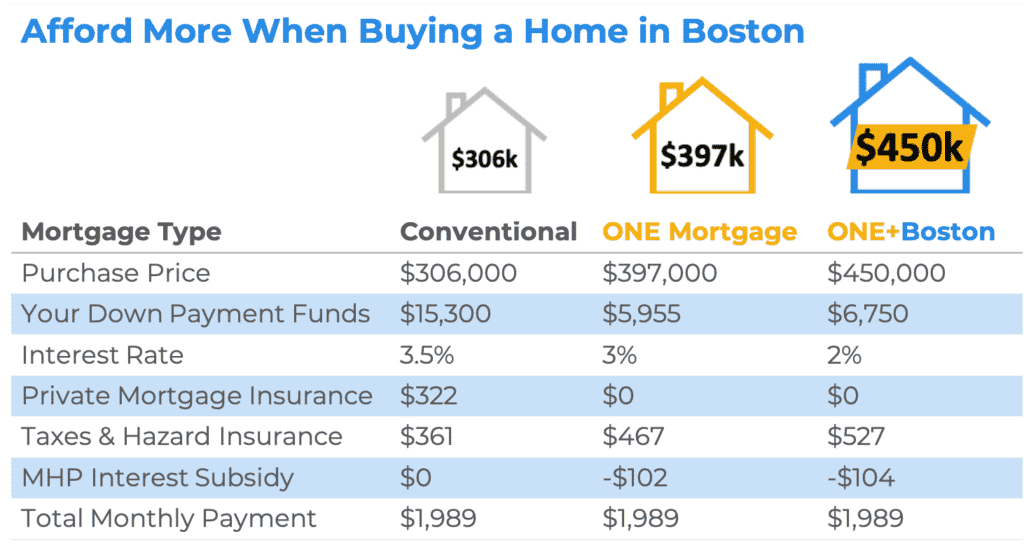

The city plans to use Community Preservation Act funds each year to write down the interest rate on an applicant’s mortgage by up to 0.5 percent off the current ONE Mortgage rate, currently 2.8 percent, or a full percentage point off if the buyer earns less than 80 percent of area median income. Qualified buyers will also be eligible for down payment and closing cost assistance through the Boston Home Center.

“This innovative program will help to make first-time homebuyers more competitive in this very high-cost housing market,” Charles Nilsen, Boston Private’s national director of residential lending said in a statement. “Boston Private is excited to participate in the program and build upon our more than 20 years of partnership with the city and state to help homebuyers build wealth by purchasing their first homes.”

Boston Mayor Marty Walsh said in an announcement Monday $4 million in CPA funds was being added to the $3.8 million which the Massachusetts Affordable Housing Alliance and the Greater Boston Interfaith Organization had asked the city to dedicated to the effort in 2018. Walsh also said he has asked the City Council to boost that funding by a further $1 million in the city’s fiscal year 2021 budget.

“Thanks to the city of Boston’s commitment, ONE+Boston will expand our ability to help moderate-income households and people of color,” Elliot Schmiedl, MHP’s homeownership director, said in a statement.

A spokesperson for the city’s Department of Neighborhood Development said officials hope to fund at least 150 buyers over the next 18 months. The mortgage product can be used to pay for single-family homes, condominiums and two- and three-family properties. Buyers are subject to income limits, available on the Massachusetts Housing Partnership website, and must have less than $75,000 in total household assets. Buyers must have a credit score of 640 or greater to buy a single-family or condo and at least 660 to buy a two- or three-family home.

“Creating pathways to homeownership means giving people the opportunity for equity and wealth building for themselves and their family. One of the most important ways to close the wealth gap is by providing the ability for wealth to be passed on from generation to generation, and homeownership is a key part of that,” Walsh said in a statement.

For example, a family of four making $119,000 a year – the area median income for a family that size – could afford a $410,000 single-family house in Boston with a conventional loan. With the ONE+Boston program, the same family could afford a $539,000 single-family house in Boston.

“We are thrilled to be partnering with Mayor Walsh, The Department of Neighborhood Development and MHP to assist more first-time homebuyers in Boston’s neighborhoods by participating in the One+ Boston Mortgage Home Loan Program. We are committed to helping residents of Boston stay in Boston,” Cambridge Trust Senior Vice President of Community Partnerships & Development Dina Scianna said in a statement.

|

|