December 2015 single-family home sales in the Bay State showed a 16.6 percent growth over December 2014 (from 4,214 to 4,913). The month capped off a strong 2015, which saw sales increase from 49,327 to 54,523 year over year – a 10.5 percent increase, according to data from The Warren Group, publisher of Banker & Tradesman.

December 2015 single-family home sales in the Bay State showed a 16.6 percent growth over December 2014 (from 4,214 to 4,913). The month capped off a strong 2015, which saw sales increase from 49,327 to 54,523 year over year – a 10.5 percent increase, according to data from The Warren Group, publisher of Banker & Tradesman.

The year was slow to start, with just 15,238 sales occurring in the first half, but picked up significant momentum once summer hit. From June through December, there were 39,274 sales, a 17.2 percent increase over the same stretch in 2014, when there were 33,501 single-family homes sold.

“The weather played a major part in delaying the market early in the year,” said Timothy Warren Jr., CEO of The Warren Group. “But the market stayed strong all the way through December because the region’s economy is very strong. Buyers felt confident in their futures, and sellers finally saw the value of their homes return to near-peak levels in many parts of the state.”

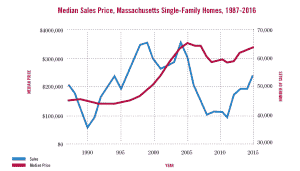

In December, the median sales price for a single-family home was $335,000, a 4.7 percent increase from the December 2014 median of $320,000. Overall in 2015, the median price for a single-family home was $340,000, a 3 percent increase from full-year 2014 median of $330,000.

Condominium sales grew in a similar fashion, showing a 22.7 percent increase in December from the same month last year (from 1,588 to 1,948) and an overall 7.3 percent increase from 2014 (jumping from 20,598 to 22,098).

For December’s condo sales, the median price was $314,110, a 1.5 percent increase from December 2014’s median of $309,500. The median price for a condo in 2015 was $316,810, a 2.2 percent rise from 2014’s median price of $310,000.

Foreclosures On The Rise

On the foreclosure front, total petitions and auctions are on the rise, but are likely indicative of an increase in tempo by lenders feeling more at ease with the regulatory environment and market conditions.

“Lenders are pushing more foreclosures through the system now that they’re both comfortable with the state’s regulations and feel they may be able to resell these properties at a good price,” Warren said. “We are not yet concerned that we’re approaching another crisis; the indications are many of these are old delinquencies that the banks delayed acting on, not a new glut of bad loans.”

December was the 22nd consecutive month of double-digit year-over-year increases (from 561 to 1,224, a 118.2 percent increase, according to Warren Group data) but these numbers still do not approach the 2,724 peak hit in December 2007 during the height of the recession.

Overall in 2015 there were 11,767 petitions filed, a 55.1 percent increase from the 7,588 filed in 2014. Petitions are the first entry in the public record in the foreclosure process, when lenders file a notice of intention to foreclose with the Land Court.

There were 563 auction notices filed in December, an 11.7 percent increase from the 504 filed in December 2014. There were 6,891 foreclosure auction notices in 2015, a 25.2 percent increase from the 5,504 in 2014. An auction notice is an alert to the Land Court that the lender has scheduled an auction and publically announced the time, date and address in legal notices in local newspapers.

There were 469 foreclosure deeds filed in December 2015, a 46.1 percent increase from the 321 deeds filed in December 2014. There were 4,399 deeds field in 2015 overall, a 21.4 percent increase from the 3,623 filed in 2014. These deeds complete the foreclosure process, indicating to the Registry of Deeds that there has been a change in the ownership of the property.