The real estate market in the commonwealth stayed hot in 2019, as demand continued to overwhelm available inventory in a story that has now played out in Massachusetts over the last several years.

The number of single-family sales ticked down slightly, rising to 59,178, a decrease of 1,067 from 2018. The median sale price across Massachusetts rose to $400,000 in 2019, an increase of 3.9 percent from the median in 2018.

The picture for condominiums was similar: 24,533 sales statewide, up all of 35 from 2018, and a median sale price of $380,000, up 4.14 percent from the year before.

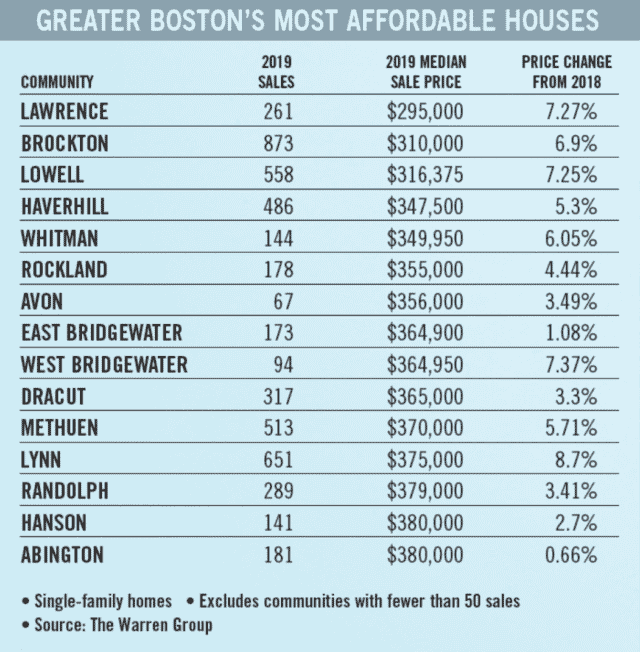

Amid a strong market in 2019 – stronger still in Greater Boston – that keeps sending prices worryingly higher, places like Brockton and Springfield that once had a hard time attracting attention saw healthy growth. And at the high end of the single-family market, many towns traditionally in high demand saw softness while the list of “million-dollar” towns gained new entrants.

Pocket of Affordability Amid High Prices

Only about 30 miles outside of Boston, with public transit and easy access to the city via highway, the fact that Brockton and its adjacent communities remain affordable always comes as a surprise to some.

Of the communities that surround Brockton – including Holbrook, Stoughton, Randolph, Easton, Avon and East Bridgewater – only Easton had a median single-family sale price in 2019 over $400,000. All communities have median prices significantly higher than their pre-recession peaks in 2005, ranging from Randolph’s 8 percent gain to Stoughton’s 13 percent increase.

Whenever it looks like economic development is really starting to pick up in the area, the market always seems to take a turn for the worst, said Melvin Vieira Jr., a Realtor at RE/MAX Destiny/Vieira Group, who does a lot of business in the area. This has generally prevented prices from appreciating as much as in other suburbs, he said.

“It always seems that the rug gets pulled out from the bottom of it” when there is momentum, he said. “It’s the ‘last one in, first one out’ mentality.”

Only Brockton, Holbrook and Stoughton saw their median sales price in 2019 rise faster than the statewide median of 4.14 percent. Brockton and Stoughton also experienced a decline in the number of sales between 2018 and 2019.

Luis Martins, a RE/MAX in agent in Brockton, said about 90 percent of his customers are coming to escape the high prices of Boston. He has sold some three-family homes for more than $600,000 and some two-family homes for more than $500,000, prices which he calls unsustainable.

Overall, both Martins and Vieira still believe the local market is strong, but also say there has been some normalization.

If a property is priced right, it will still be snapped up with contingencies waived, they say. But if a home is priced too high, it could sit for some time.

Mixed Bag in Luxury Market

Mixed Bag in Luxury Market

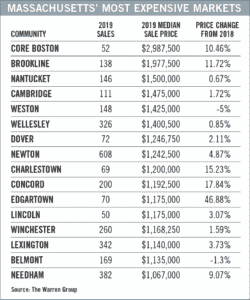

Not all was rosy in the always–hot and always–expensive luxury single-family market.

Some communities continued their old ways. Towns like Concord, Brookline and Needham experienced year-over-year median sale price increases of roughly 18 percent, 12 percent and 9 percent, respectively.

But nearby luxury markets such as Weston, Wellesley and Winchester cooled off. The median sale price between 2018 and 2019 dropped 5 percent in Weston, and only rose 0.85 percent in Wellesley and 1.6 percent in Winchester.

So, what gives?

Towns like Concord and Brookline saw the number of sales decline year-over-year at a faster rate than towns like Weston and Winchester.

“Baby Boomers are realizing that the cost per square foot in urban markets is higher than in the MetroWest and that might be shifting supply,” said Amy Mizner, a Realtor at Gibson Sotheby’s International Realty. “Empty–nesters are fixing their homes up instead of entering into the expensive condo market.”

Mizner also said that Millennial buyers are very rarely interested in putting any sweat equity into new homes, making communities with older homes like Winchester potentially less appealing than other nearby luxury markets with more new construction.

Buyers searching for more affordable homes are crowding into once-overlooked areas like Brockton and its suburbs, or Springfield and Chicopee.

At the same time, these new homes are getting much more expensive, added Jared Wilk, a Realtor at Compass’ new team, The Shulkin Wilk Group.

“This applies to Needham but also in general to Concord and Brookline, where the [land] acquisition cost for new construction homes is getting so high,” he said. “To acquire a piece of land or tear down a home is so difficult… plus the cost of materials is going up. For these new construction homes, sales prices are going up, but margins are diminishing.”

Wilk added social media has shaped luxury buyers’ tastes, with wish lists getting longer than ever before. Materials like high-end wallpaper, commercial–grade appliances and quartz countertops are now regularly in demand, he said.

Both Mizner and Wilk do not see the luxury market slowing down anytime soon and expect a hot spring. The market may start to normalize closer to the election, but it is still too early to tell, they said.

Limited Inventory Ups Pressure in Pioneer Valley

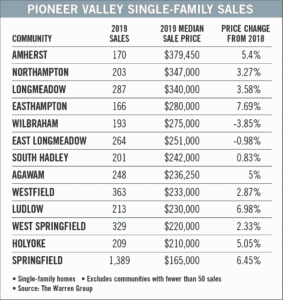

Affordable housing issues are making an impact on Pioneer Valley’s real estate market, as traditionally weaker markets like Springfield and Chicopee saw better price appreciation than wealthier communities in the area like West Springfield and Longmeadow.

The median sale price in Springfield rose 6.45 percent year-over-year to $165,000, and 5.56 percent in Chicopee to $190,000, both faster than the statewide median year-over-year increase of 3.9 percent.

The median sale price in Springfield rose 6.45 percent year-over-year to $165,000, and 5.56 percent in Chicopee to $190,000, both faster than the statewide median year-over-year increase of 3.9 percent.

Meanwhile, median sale price in West Springfield only rose 2.33 percent to $220,000, and 3.58 percent in Longmeadow to $340,000, respectively. Agawam served as a bit of an anomaly, however, seeing 5 percent growth in its 2019 median sale price, which finished the year at $236,000.

“The move–up buyers aren’t moving up and the downsizers aren’t downsizing. Those houses priced between $300,000 and $500,000 are just stagnant and sitting on the market,” said Sue Drumm of Coldwell Banker, adding that the area lost a large amount of inventory between 2018 and 2019. “Until we can conquer affordable housing, we are going to be stuck in this loop that we are in because there is nothing out there for first-time homebuyers to buy, because downsizers have nowhere to go.”

In communities like Springfield and Chicopee, Drumm said it is not uncommon to see multiple offers and 30 to 40 parties coming through an open house.

“If you don’t have a strong offer and strong financing and no contingencies, you don’t have a shot,” she said.

Drumm said all indicators suggest another very strong real estate market in the area in 2020, but that there is going to have to be a serious increase in supply or zoning changes to really see people moving up or downsizing.

|

|