In multiple-offer scenarios, some sellers may chose to go with buyers using conventional loans out of fear that an FHA loan’s stricter underwriting needs could scupper the sale.

Tanisha Salmon works with a lot of first-time homebuyers who generally look for properties in places like Brockton, Stoughton and Randolph. About 95 percent of her clients use FHA loan products to enter the Massachusetts housing market.

“We wouldn’t have any hesitation with putting in an offer” using an FHA mortgage before the pandemic, the South Easton-based Keller Williams Realtor and Greater Boston Association of Realtors board member said. Today though, “I have to really tell my buyers before putting in an offer that ‘Because of the product that you’re using, your offer may not be accepted.’”

With home prices at an all-time high, low housing supply, cash offers and waived contingencies, would-be homebuyers preapproved for FHA mortgages have been consistently outcompeted in the red-hot Massachusetts housing market. As agents encourage their buyers to persevere, area housing experts fear that homeownership, key to wealth-building, will be increasingly unattainable for low and moderate-income residents in the commonwealth, at least for the short-term.

Accessible Loans Sought

The current wave of demand for homes has crashed into a wall of sellers holding back from the market. Combined with the rapid pace of home sales, the lack of inventory has sent prices soaring.

In Massachusetts, the number of condominiums for sale in May was 40.9 percent below the number available in May 2020, according to the Massachusetts Association of Realtors. For single-family homes, the decrease was 63.7 percent. At the same time, median single-family home prices increased by 20.8 percent year-over-year, while condominium prices increased by 11.5 percent according to The Warren Group, publisher of Banker & Tradesman.

“This is probably the worst housing market that we’ve seen in the 55 years that my organization has been in existence,” Leslie Reid, CEO of Madison Park Development Corp., said. “It’s never been a more challenging market for first-time low-income buyers to get a hold.”

And with record-low interest rates boosting Bay Staters’ homebuying power to new highs, many hopeful homebuyers are turning to FHA products because of their low down payment and credit score requirements.

Before the pandemic, FHA loans made up an “outsize share of loans to Black and Hispanic/Latinx borrowers,” according to a recent analysis of Home Mortgage Disclosure Act data by the UMass Donahue Institute.

FHA loans comprised about 15 percent of all Massachusetts purchase mortgages in 2019, 19.4 percent of all such loans to low-income borrowers, 24 percent of loans to moderate-income borrowers and 18.7 percent of loans middle-income borrowers, according to that analysis. Warren Group data shows the number of FHA purchase loans closed through May 31, 2021 jumped 40.06 percent over the same period in 2019.

Jennifer Rose, a residential sale specialist at Thalia Tringo & Assoc. in Somerville, has co-led first-time homebuyer classes in Somerville since 2013. Over the past year, her roster of clients qualifying for FHA mortgages has doubled, she said.

The Massachusetts Housing Partnership (MHP) has seen a similar trend, said Director of Homeownership Elliot Schmiedl. Twice as many first-time homebuyers are calling and emailing than before the pandemic, and “there’s two to three times more people” in their first-time homebuyer classes, he said.

Homeownership is seen as vital to closing Massachusetts’ racial wealth gap, but a popular tool used by first-time homebuyers – an FHA mortgage – comes with added strings.

‘Stigma’ During Competitive Market

Yet offers made possible by FHA preapproval increasingly serve as a red flag to sellers’ agents.

“There is a stigma. There’s definitely a stigma of FHA buyers – knowing that folks have lower income or lower credit can make many sellers kind of weary,” Raheem Hanifa, a research analyst at the Joint Center for Housing Studies at Harvard University, said.

That wariness includes concern that FHA’s additional appraisal requirement will uncover problems to be redressed, unraveling an accepted offer at a time when many listings yield multiple, lucrative offers over asking price.

“Sellers are hedging their bets to avoid that,” Hanifa said.

“All it takes is one bad experience with an FHA loan,” to create a bias, said Kyle Regan, senior loan officer at Superior Rate Mortgage, who works frequently with Salmon.

While Rose understands sellers’ concerns, she hasn’t seen offers from buyers with FHA loan preapproval sour more often than those with conventional mortgage preapproval. According to Ellie Mae’s April 2021 Origination Insight Report, conventional mortgages took 51 days to get to closing while FHA Loans took 53 days. She encourages her FHA-funded clients to persist.

Salmon has seen clients unsuccessfully bid on up to 15 houses.

“What they have for a down payment is pretty much their life savings,” she said. “They feel that they really still can’t break through this wealth gap.”

High Prices Limit Buyers’ Options

In the short-term, first-time homebuyers of color, in particular, are being edged out of the market or forced to buy in locations not really of their choosing, in large part by price.

Buyers using FHA loans tended to concentrate in Massachusetts’ lower-priced, working-class Gateway Cities like Springfield, Brockton and Lawrence, where the loans can make up between 1 in 4 and 1 in 2 first-lien mortgages, the Donahue Institute analysis of HMDA data found.

A May 17 report by MassINC’s Gateway Cities Innovation Institute found that between one-third and one-half of these buyers are purchasing homes in “distressed” neighborhoods with high rates of poverty, long-term vacancy for residential housing units and high residential turnover from year to year.

“I don’t think it’s intentional segregation, but we’re seeing it. people are thinking ‘This is the only place we can afford to buy,’” Denisha McDonald, a Boston-based Realtor with The Mandrell Co., said in a panel discussion of the report’s findings organized by the Massachusetts Community and Banking Council.

The meteoric rise in Greater Boston home prices puts buyers on the low end of the market in a bind, MHP’s Schmiedl said. When a would-be buyer decides to delay home shopping, it’s “a somewhat scary prospect because you just don’t know if the market’s going to keep going up and up,” he said.

“That person’s missed out on a whole year of wealth-building opportunity or appreciation” if it does, he said.

“This definitely does exacerbate long-standing disparities and inequalities around wealth and housing that have gone back for generations,” Hanifa said.

More Education, More Inventory Needed

More Education, More Inventory Needed

Not surprisingly, one suggested remedy is increasing housing supply.

Eric Shupin, director of Public Policy at the Citizens’ Housing and Planning Association, noted that the recent Housing Choice zoning reform could help create more diverse and affordable housing, particularly in communities with MBTA stops. But the additional housing produced must be more affordable for first-time homebuyers, with a price tag of around $400,000 or less.

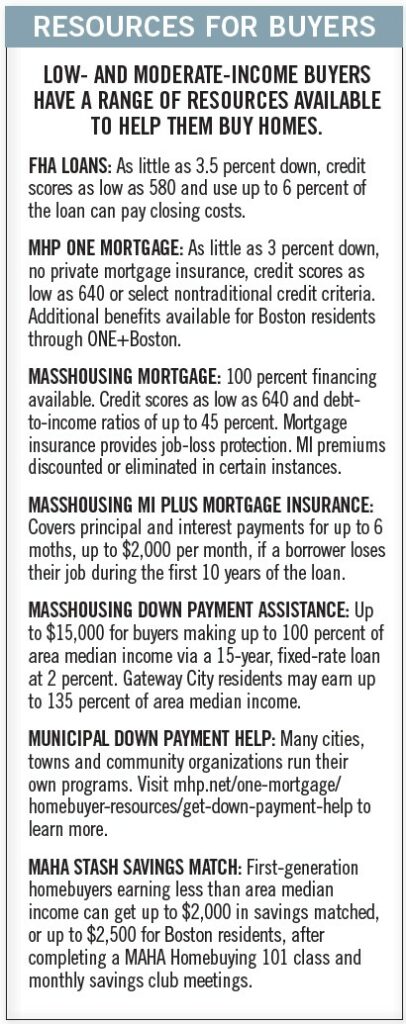

“And then the other side is the actual resources: the loan products, the down payment assistance that will help that particular household then buy that home,” Shupin said. “We need to work on both of those things to increase homeownership opportunities, particularly for low- and moderate-income households and communities of color.”

Those loan products include MassHousing loans and down payment assistance programs and Madison Park Development Corp.’s own down payment assistance program, as well as MHP’s ONE Mortgage program, which unlike FHA loans does not require private mortgage insurance, saving buyers hundreds of dollars each month. These mortgages products for lower-income buyers have different requirements than FHA loans and, anecdotally, don’t carry the same stigma. Ideally, Shupin said, more lenders would offer these loans.

Educating real estate agents is crucial, said Keller Williams’ Salmon. Sellers rely on their agents to sort through different offers, and agents unfamiliar with FHA loans don’t really understand them, she said. She also urges agents to evaluate each buyer, rather than loan type.

“Talk to the loan officers and learn about the product, learn about the client,” she said.

And Regan, the Superior Rate loan officer, thinks those in his role should contact agents directly.

“That could be a missed opportunity to educate,” he said. “That should probably become an industry standard.”

For her part, Madison Park’s Reid suggests bold policies around fair housing and zoning can make more homes available for more buyers.

“We really need policies that are remedial. They need to remedy all of the damage done by past policies and outcomes that created obstacles,” she said.

Despite the challenges, Reid is optimistic George Floyd’s murder and the resultant spotlight on racial inequities is combining with the current housing crisis in a powerful way.

“I see a moment that catalyzes the changes that we need and how resources are allocated, and changes of policy to explicitly address these challenges,” she said. “So, it’s that thing of it’s the worst of times, it’s the best of times.”

Staff writer James Sanna contributed to this report.

|

|