We all know nothing lasts forever, and that includes real estate bull markets, which have a tendency to crash just as everyone starts believing home prices won’t ever go down again.

But predicting the next downturn is a bit of a crap shoot, especially when there is no obvious evidence of a potential bubble, as there was with the subprime mortgage mess before the Great Recession.

Still, looking at the patterns of the past can shed a little light on where we are in this current real estate and where we might be headed. And surprisingly, despite more than a half decade of home price increases, upward pressure on real estate values appear to be picking up speed.

There’s a lot of talk now about the national economy heading into its ninth year of an expansion – and worries about the inevitable recession that is in the cards, though fears have receded as growth has picked up speed over the last year or two.

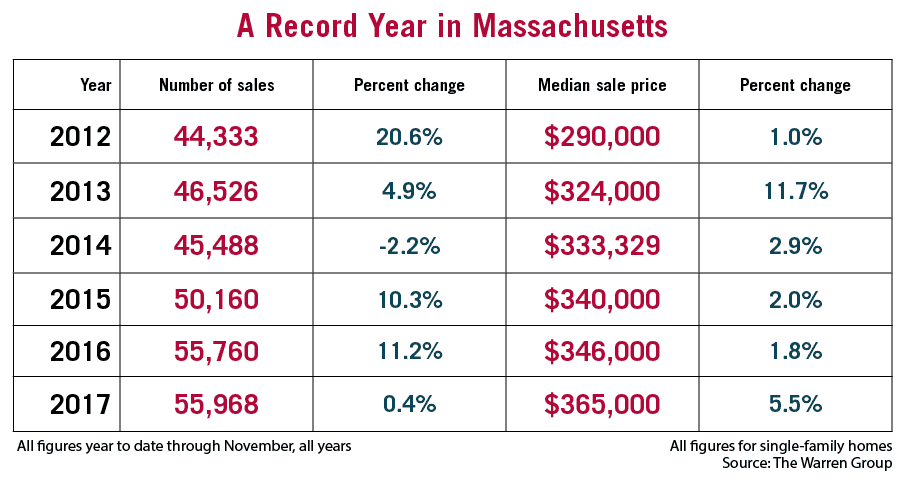

The final price for the year won’t be in for a few weeks. However, year-to-date Warren Group stats for Massachusetts through November point to what is likely to be six years of single-family home price increases since the Great Recession once the book closes on 2017.

That sounds like a long run, until you take into consideration that residential real estate values, after hitting bottom in 1993/1994 in the aftermath of the 1980s boom, posted 11 straight years of increases, only peaking in 2005.

During that time, the Massachusetts median single-family home price more than doubled, from $142,250 in 1994 to $356,250 in 2005, Warren Group numbers show. The bursting of the subprime-mortgage-driven real estate bubble, followed by the Great Recession, sent prices plunging over the next four years and pushed the state’s median price down to $285,000 in 2009 – a 20 percent decrease.

Since then, prices have bounced back to $365,000, for a rebound of 28 percent. That’s more than respectable, but far from the doubling – and then some – we saw between 1994 and 2005.

That said, the pace of price increases may also be picking up, with the state’s median single-family home price jumping 5.5 percent through November compared to the same period the year before. Though it’s not quite the 11.7 percent hike that happened between 2012 and 2013 when values began their comeback, it is definitely higher than the modest 1.7 percent bump seen in 2016.

Greater Boston Leads the Charge

Boston and its suburbs are leading the way when it comes to this growing momentum.

Just two years ago, single-family home prices in Boston-dominated Suffolk County posted a sizable but hardly overwhelming 4.7 percent jump, boosting the median price of a single-family home to $425,000. But as of the end of November, Suffolk had posted a 9 percent gain in home prices in 2017 compared with last year, for a median of $495,000.

The same story can be found with the relatively affluent western and southern suburbs covered by Middlesex and Norfolk counties.

Back in November 2015, Middlesex posted a 4.2 percent gain for most of the year compared to 2014, for a median of $461,000, while Norfolk saw its median home price edge up 2.6 percent, to $430,000.

Fast forward two years and both counties are seeing home prices grow at nearly double or triple their previous rates.

Middlesex is coming off a 2017 where its median single-family home price hit $515,000, for a 7.3 percent gain, while Norfolk passed the $477,000 mark after an identical 7.3 percent jump.

Home sales are also poised for another big year, with 55,968 sold across Massachusetts through the end of November. That’s above the mark for the same time in 2016 and the best showing since 2005.

The sales number is misleading, though, for it comes despite a record low number of listings across the state. The number of homes on the market has been on the decline for years, a combination of homeowners reluctant to try to move up in a tight market and a dearth of new residential construction.

The sales number is misleading, though, for it comes despite a record low number of listings across the state. The number of homes on the market has been on the decline for years, a combination of homeowners reluctant to try to move up in a tight market and a dearth of new residential construction.

The shortage of homes for sale, combined with a strong local economy in which growing tech and biotech sectors draw in relatively well-paid talent from around the country, are big factors fueling the increase in home prices.

Boston has certainly made progress pushing new condominium and apartment development, but new home construction in the suburbs, where most people still live, continues to lag.

Frankly, there’s no sign of any big shift ahead in these fundamental conditions. And that means we could be in for three or four – or more – years of rising prices, especially in the Boston area.