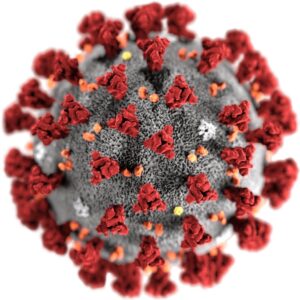

An illustration of the new coronavirus that causes the disease COVID-19. Image courtesy of the Centers for Disease Control.

Federal and state regulators are encouraging financial institutions to meet the needs of customers affected by the coronavirus, indicating that examiners would not hold these efforts against banks and credit unions.

The agencies said in a joint statement that they would provide appropriate regulatory assistance to affected institutions and recognized “the potential impact of the coronavirus on the customers, members, and operations of many financial institutions.”

The joint statement was released March 9 by the Federal Reserve System, the Consumer Financial Protection Bureau, the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the National Credit Union Administration and the Conference of State Bank Supervisors.

Regulators advised financial institutions to work constructively with borrowers and other customers in affected communities.

“Prudent efforts that are consistent with safe and sound lending practices should not be subject to examiner criticism,” the agencies said.

The statement also noted that the agencies would work with the financial institutions they supervise to address challenges resulting from the coronavirus outbreak.

“The agencies understand that many financial institutions may face current staffing and other challenges,” the statement said. “In cases in which operational challenges persist, regulators will expedite, as appropriate, any request to provide more convenient availability of services in affected communities.”

Regulators will also work with affected financial institutions in scheduling examinations or inspections to minimize disruption and burden.

|

|