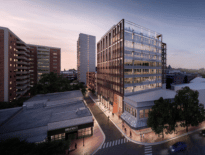

Sales activity at the Echelon Seaport complex in Boston has rebounded to pre-COVID levels, with an average eight to 10 closings per month. Image courtesy of Cottonwood Group

The Boston real estate market has been experiencing a wild ride since mid-2020 when COVID-19 appeared on the scene. The speed of the precipitous pricing decline for both urban core rental and for-sale product surpassed even 2008’s historical crash.

Between the second quarter of 2020 and the fourth quarter of 2020, rental rates had dropped as much as 15 percent, and home sales hovered around 7 percent below their previous asking prices.

However, by the end of last year, signs of stabilization and an upward trajectory in the market signaled a recovery that was astonishing by many indicators. Rental occupancy rates are now higher than they were in the height of 2019 and rental rate growth has rebounded over 12 percent in three months.

Boosts in these market indicators have allowed landlords to reduce their concessions of up to three months of rent and increase their rental rates while concurrently accomplishing high occupancy numbers – back up to the mid-90-percent range. All this activity will bode well for the new product that is continuing to be developed in Greater Boston. With over 10,000 units coming online by 2023, this energetic activity level is more than welcome.

Condo Market Remigration Begins

The for-sale condominium market never fell quite as far. As the result of a bolstering the fourth quarter of 2020, the year ended up with a very stabilized annual picture – both in absorption and price. While 73 percent of the sales production was between $500,000 and 1.5 million, the average sale price was $1.175 million and absorption totaled over 3,000 units, very similar to that of 2019.

As encouraging as those figures were, the dearth of high-end luxury closings was apparent. Empty-nesters were not leaving the suburbs, foreign purchasers could not get into the country and affluent buyers left the city for country homes.

By the end of the first quarter, a “re-migration” to the city had begun. With the distribution of COVID-19 vaccines, students returning to school, employers encouraging a return to in-office attendance and the relaxation of the city’s social distancing regulations, buyers have reemerged.

And they have done so with a vengeance. Pent-up demand coupled with a desire for socialization and continued low interest rates has resulted in a robust spring market for luxury product. In the past five weeks, there have been six closings over $12.5 million, averaging over $3,570 per square foot. Echelon, Boston’s largest luxury development, is now back to recording eight to 10 sales per month, a pre-COVID absorption pace.

No ‘COVID Discount’

It is also interesting to note that 2019 averaged 7.25 sales over $5 million per month. However, during the past two months, we have already averaged 8.5 sales over $5 million per month. Even more astonishing, these numbers represent predominantly resales, averaging $8.9 million.

Sue Hawkes

While there are still units remaining at some of the new buildings – One Dalton, Pier 4, Echelon – the reality is that the depth of the luxury new market inventory is not significant. The total of the remaining existing units, coupled with those currently under construction at the Raffles, St. Regis, The Quinn, The Sudbury, South Station and Shawmut, is still only approximately 650 units, all set to be delivered between now and 2024.

Negotiations on existing inventory have been conservative, depending upon the inventory remaining in the building. Certainly, small concessions, such as condo fees, upgrades or parking fees have been available, but the 10 percent “COVID discount” never materialized.

Boston has emerged quickly and defiantly. Our economic engines, strong human capital and resilient education industry have buoyed the marketplace quickly and resoundingly. Development is proceeding, retail is pushing the reset button and city life is back. And along with it are those affluent buyers, anxious for a return to the energy that Boston has to offer.

Sue Hawkes is managing director of The Collaborative Cos.

|

|