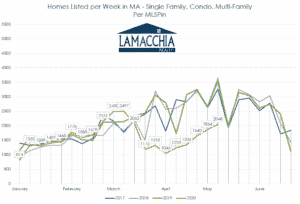

The number of homes listed in Massachusetts in recent weeks. As the orange line shows, many sellers paused in March and April, setting the stage for an active summer market. Image courtesy of Lamacchia Realty

Although COVID-19 has certainly caused a massive slowdown in the market, mainly due to a lack of home sellers listing their homes, assuming that this will turn into a replay of the 2008 crisis is likely inaccurate. As of right now, our real estate market does not look anything like the 2008 market for four reasons: lower inventory levels, stronger mortgages, proactivity of mortgage companies and government-sponsored enterprises and unprecedented government intervention. Furthermore, as the country prepares to reemerge back to normal life, we are likely to see the busiest summer ever in what will be a very quick recovery.

Lower Inventory Levels

In 2008, the housing market started to crumble as inventory rose so high – over 400 percent higher (11,000 homes for sale in Massachusetts now compared to 47,000 then) than in 2020 – that almost no seller could find a buyer for their home. List prices subsequently declined which brought home values with them. There was excessive supply and very little demand, which kills market values.

2020 inventory levels have been lower than ever recorded and so there is no slack in the market to cause a drop in prices at this time. The fear that homeowners will be upside–down on their mortgages is not currently based in fact. High demand and limited supply creates a seller’s market and therefore drives prices up, which is the exact opposite set of circumstances to 2008.

A Stronger Mortgage Market

As of March 2020 mortgage delinquencies had been declining since 2010, so even though the virus caused a rise that started in April due to massive layoffs and increasing unemployment in Massachusetts and the nation, the level of delinquencies kicked off at a 10-year low. In addition, most people are obtaining permission to not pay for at least three months by way of obtaining a forbearance on their mortgage. These forbearances will not count as delinquent because they will not even be reported to credit.

The financial health of the mortgage market is in much better standing now than it was in 2008. For starters, the median credit score in 2008 was 731 and in 2019 it was 770. Higher credit scores ultimately mean that buyers are more qualified to borrow, which was not the case leading up to 2008, particularly with the predatory lending that was happening up until about 2007. Many mortgages at the time were given to underqualified borrowers who would never qualify for the same loan today.

Mortgage Companies are Already Proactive

The Great Recession was exacerbated by a lack of intervention by banks, many of which were themselves falling apart. Distressed borrowers would contact their mortgage companies to apply for forbearance, and if they could even get in touch would be told that they’d have to be delinquent to be granted forbearance or a loan modification. Naturally, they’d go delinquent by intentionally missing payments, and then call back only to be told by another person that because they’re delinquent they couldn’t qualify. This broken loop would push people into foreclosure.

![]()

Tim Warren: Market Conditions Offers Reasons for Optimism

Agents Face New Challenges in the Virus’ Wake

Colleen Barry and Dino Confalone: What Will Happen to Luxury Condos?

Kurt Thompson: What Realtors Need to Know About What’s Changed

Bernice Ross: How to Price Property in a Post-COVID Market

Conversely, in the wake of this outbreak and its subsequent layoffs, furloughs and – most notably – sickness, mortgage companies with government-sponsored loans were very quickly mandated to allow forbearances without even a requirement for validation of hardship. Though we may still see foreclosures and short sales, the surge we saw in 2008 will probably be avoided due to the timely response of the mortgage industry.

Unprecedented Government Intervention

The government is essentially doing everything differently this time around. Last time, there were big signs of a major slowdown starting in 2006, but it took until the fall of 2008 for the government to make major moves and put real backstops in place to stop the bleeding. This time, they are doing it already.

It’s fair to say that the immediacy of government intervention in 2020 is as unprecedented as the virus itself. Literally no time has been wasted in the deployment of relief programs offered by the government. The $2 trillion CARES Act has many benefits for consumers and businesses, starting with unemployment benefits padded by an extra $600 a month, and even offers 1099 employees unemployment, which has never been done before.

Moving Forward: The Summer Market

Moving Forward: The Summer Market

We are seeing a consistent pattern of the market turning back on. There’s no doubt for sellers that the next few weeks will be very lucrative. The number of homes listed is still down over this time last year, so buyers will compete for the homes they want, which typically drives prices up. Because many sellers paused in March and April (see the orange line in the graph), all those listings are now being place on this market on top of all the sellers who were already planning on listing in the early summer.

As sellers become restless and list their homes that orange line is going to shoot up higher than any of the levels depicted in recent years, and it’s already on that trajectory. Many buyers are frustrated with the lack in current inventory, most listings are accepting offers almost as quickly as they are listed. All of this points to a very active market that is nowhere near crashing like it did in 2008.

Anthony Lamacchia is broker/owner and CEO of Lamacchia Realty in Waltham.

|

|