Winners in a Bad Year

Massachusetts banks, credit unions and mortgage companies all took major hits in residential lending, but there were a few brights spots that helped some lenders come out on top.

Massachusetts banks, credit unions and mortgage companies all took major hits in residential lending, but there were a few brights spots that helped some lenders come out on top.

Homeowners are increasingly tapping their equity, taking advantage of big gains following years of soaring housing prices.

While banks and credit unions have long dominated the market for home equity lines of credit, Massachusetts has seen other lenders – both familiar and new – make headway in the second mortgage market amid rapid changes to the industry.

Hometap, a Boston-based fintech that provides an alternative for tapping into home equity without taking on debt, has secured $100 million in new financing.

Home equity lines of credit could be a major opportunity for lenders in coming years because many homeowners simply don’t know what they are.

If you’ve got it, don’t piggybank it – borrow against it.

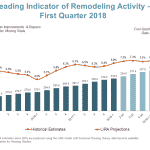

The robust pace of spending on home renovations and repairs is expected to stay strong over the coming quarters, according to the Leading Indicator of Remodeling Activity released today by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University.

Americans are awash in record amounts of equity in their homes, posing the question for millions: So what do we do with it?

Last week it was mortgage lenders deservedly fretting about the future of their industry; this week it’s HELOC and home equity loan originators.

Now that the recently enacted tax reform bill has eliminated the interest deduction for home equity loans, it is hard to predict how the product will perform going forward.

A different method of compensation for HELOC originations might give some banks and credit unions a strong advantage over non-depository institutions. So why aren’t any institutions trying this?

An article posted on realtormag.com last week reports that more homeowners are tapping into their home equity. Loan originations rose 8 percent to almost $46 billion in the second quarter of 2017, the highest level since 2008, according to Equifax.

Community banks and credit unions will enjoy some regulatory relief after the Consumer Financial Protection Bureau yesterday amended the Home Mortgage Disclosure Act to up the reporting threshold regarding home equity lines of credit.

Many credit unions in Massachusetts will no longer have to report home equity line of credit (HELOC) data to federal regulators after the U.S. consumer watchdog agency earlier this week vowed to raise the reporting threshold.

Lenders always expect HELOCs to be simpler than closed-end mortgages.

Senior management and the boards of directors are ultimately responsible for an institution’s compliance.