At the unveiling of a new proposal to fund transportation infrastructure in Massachusetts on Feb. 26, 2020, Speaker Robert DeLeo said House leaders "tried to keep everyone who uses our roads in some fashion involved with the payment of it." Photo by Sam Doran | State House News Service

Almost a year in the making, expectations for the roughly $600 million tax bill rolled out Wednesday by House Speaker Robert DeLeo to pay for improvements in the state’s transportation system were high, and varied.

While most advocates for new transportation revenues to improve the condition of roads and bridges and deliver more reliable, affordable public transit were pleased to see progress, several said they had hoped the bill would have gone further.

Business groups were pushing for a major gas tax increase and a one-year study of congestion pricing and tolls. Progressive lawmakers wanted corporations to help pay for public transit and road improvements. And Gov. Charlie Baker just wanted authorization to borrow more money to beef up the state’s capital program.

In the end, keeping everyone happy proved difficult.

“I think we tried to keep everyone who uses our roads in some fashion involved with the payment of it,” DeLeo said Wednesday, after presenting the plan to House Democrats in a private caucus.

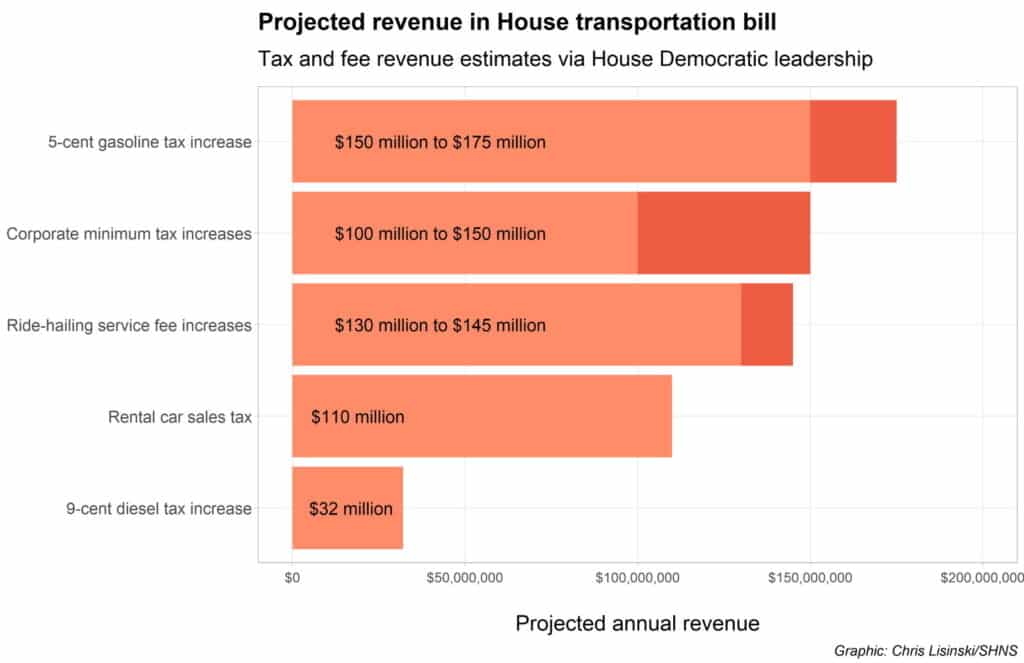

The plan calls for increasing the gas tax by 5 cents for most drivers and 9 cents for diesel. It also raises fees on Uber and Lyft rides by up to $145 million, and asks corporations to pay as much as $150 million in higher minimum taxes, which have not been adjusted in 30 years.

House leaders are also proposing to eliminate an exemption for rental car companies that has allowed them to avoid paying the sales tax on new vehicles purchased in Massachusetts for their rental fleets.

‘Process’ Applauded

“That they were able to come up with a bill was certainly an accomplishment,” said Rep. Tricia Farley-Bouvier, a Pittsfield Democrat and co-chair of the House Progressive Caucus.

Farley-Bouvier said the caucus appreciated the “process” House leaders used to develop the bill, holding a series of meetings to listen to different groups of lawmakers with, at times, divergent interests.

Rep. Sarah Peake, a Provincetown Democrat and a division chair on DeLeo’s leadership team, on Tuesday said Straus and Michlewitz “went to a lot of trouble to carefully listen to all the stakeholders, and our comments were included” in the bill’s approach.

Bill’s Scope Criticized

Transportation for Massachusetts Director Chris Dempsey – whose group called for a 25-cent increase to the gas tax and ride-hailing fees scaled at 6.25 percent of the cost of solo trips – called the proposal a “step forward” to make new investments in public transit possible, but said the coalition would “work to strengthen the final bill.”

A Better City CEO Richard Dimino said his organization would like to see the House commit to a congestion pricing and equitable highway tolling plan within the next two years. The bill only calls for a study of the topic to be completed by July 31, 2021.

“While $600 million is a good starting point, we believe additional funding is needed to fix our roads, bridges and transit as well as fund expansion and resiliency efforts,” Dimino said.

Livable Streets Executive Director Stacy Thompson also called the bill “a positive first step,” but added that, “It’s not bold enough to meet the scale of our transportation crisis.”

“While it’s a good start to include some dedicated revenue for the MBTA and the RTAs, important policies like making fares more equitable are missing from this package,” she said.

DeLeo: Bill Is a ‘Bridge’

DeLeo, on several occasions Wednesday, described the scale of the bill as a “bridge” to the future when voters might have the chance in 2022 to weigh in on a ballot question to generate $2 billion by adding a surtax on household income over $1 million.

The speaker also said it is “iffy,” but still possible, that a regional cap-and-trade program known as the Transportation and Climate Initiative being negotiated by Gov. Baker with other states for vehicle emissions will general significant new money for transportation.

Senate President Karen Spilka, who has said she would like to use new revenue to lower public transit fares, said the Senate “looks forward to beginning in earnest the exchange of idea between the House and Senate that will result – we hope – in a safer and more effective transportation system for the entire commonwealth.”

“The Senate believes we need to take action to change behavior to reduce congestion, provide fare relief to low income residents, and expand and improve public transportation in every region,” Spilka said.

Concerns Raised on Business, Gas Taxes

The House proposal would create a tiered structure, increasing the corporate excise tax for all companies with over $1 million in sales from its current level of $456. The top tier of companies with over $1 billion in sales would pay a minimum excise tax of $150,000.

“This is a troubling signal to business in a time when cities and states around the country are competing for jobs and economic growth,” the Greater Boston Chamber of Commerce said in a statement.

Massachusetts High Technology Council Vice President Mark Gallagher also wrote a letter to House Ways and Means Chairman Aaron Michlewitz calling the bill an “unnecessary and ill-advised departure from the policy path that has helped make the Massachusetts economy the envy of the nation,” He said the council was especially opposed to the corporate minimum tax proposal and higher ride-for-hire fees.

The High Tech Council played a central role in convincing the legislature to repeal a sales tax on software services that was part of the body’s last, failed attempt to raise new revenue for transportation in 2013.

And the Raise Up Coalition said it was pleased that businesses were asked to contribute, while the gas tax increase, which is considered regressive, was kept relatively small.

“Today we know we are being heard, but there is still a long road to travel,” said the Raise Up Coalition in a statement.

House members will have until Friday at 5 p.m. to file amendments to both the tax bill and a separate $14.5 billion transportation bond bill. The House plans to debate the revenue bill this coming Wednesday, and the bond bill on Thursday.

“This is a tax increase in an election year, and everyone is looking to have an impact on their district,” Majority Leader Ron Mariano, of Quincy, acknowledged ahead of next week’s debate. “So the approach to this was we will listen, we will evaluate your concerns and try to address them in this first step. And again, I want to stress this. This is just the beginning. This is nowhere near the identified needs.”

|

|