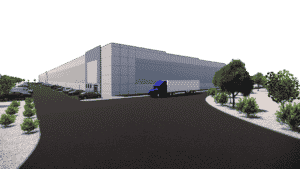

Lincoln Property Co. recently began site work at 160 Mechanic St. in Bellingham, where the developer will construct a 345,000-square-foot distribution facility. Image courtesy of Lincoln Property Co.

With the holiday season in full swing, warehouses are operating at full tilt, around the clock. Billions of packages will be delivered across the country with the U.S. Postal Service estimating that it alone will deliver 900 million packages to eagerly awaiting children and anxious parents.

Surging demand from online retailers, logistics operators and product suppliers has put immense pressure on Greater Boston’s warehouse market. Current vacancy measures single digits, and the true vacancy rate, which removes antiquated and functionally obsolete supply, reads below 5 percent.

Not all warehouses are created equal and the technology and design behind today’s facilities bears tremendous impact on day-to-day life. They may not seem important at face value, but every small design choice impacts how quickly that Amazon Fresh package arrives to your front door or a W.B. Mason box reaches the office supply closet.

What Today’s Warehouses Need

Through myriad, complex warehouse specifications, the most important design element is really quite simple: volume. Greater volume directly translates to increased storage capacity which creates the opportunity for increased productivity.

In Greater Boston, large swaths of developable land are few and far between. As a result, warehouses are often unable to spread horizontally, so the only alternative to increase volume is to rise vertically. In most cases that means increasing clear height, hence the moniker “high-bay” warehouse, meaning one with heights of 30 feet or greater. Some markets outside of Boston are now testing multi-story warehouse design, but that’s a story for another day. Currently, only 12 percent of Greater Boston’s warehouse inventory is high-bay, perhaps one of the nation’s worst ratios.

Today’s market calls for 36-foot-plus clear heights which in turn means developers are forced to pour thicker, perfectly level slabs to support additional loads. Wider column spacing is required to accommodate a range of new, high-rise racking systems. Heavy duty life safety, electrical capacity and LED lighting are also now the market standard. Outside of the building envelope, trailer storage as well as wider and deeper loading bays are required to increase maneuverability and maximize efficiency.

Spec Developments Spread in the Suburbs

Currently across eastern Massachusetts there is roughly 2 million square feet of premium warehouse space under construction. Most recent to break ground, Lincoln Property Co. began sitework at 160 Mechanic St. in Bellingham where our company will construct a 345,000 square-foot, state-of-the-art, 36-foot clear height distribution facility with 70 dock doors, 50 trailer parking spaces, LED sensor lighting and ESFR sprinklers. LPC, in conjunction with its partner Barings, have hired ARCO National Construction Co. to build “Lincoln Logistics 36,” which will be ready for occupancy late fall 2020.

On the leasing front, Lincoln Property Co. has already had encouraging conversations with multiple users. Currently there are only four options for high-bay space above 300,000 square feet. We are in a unique marketplace where land and political constraints are extremely restrictive, so development is essentially capped.

It wouldn’t be a real estate conversation today with mentioning Amazon. The e-commerce titan has multiple LOI’s out for large fulfillment and sortation centers, as well as smaller delivery and Prime Now hubs. Recent leases in Revere and Dedham exceed 1 million square feet while a transaction for an additional 300,000 square feet at 351 Maple St. in Bellingham is reportedly deep in negotiations with the base rent potentially surpassing $8 per square foot, pending the landlord’s work allowance. Warehouse rents stagnated in the $6 per square foot range for the majority of 2015-2018, however they have popped recently and now measure in the low $7–per–square–foot–range.

Ethan Robert

The largest pre-lease commitment comes at Barings and GFI Partners’ 100 Franklin Park. The partnership secured a 300,000 square foot lease commitment from Imperial Dade. The project began construction on a speculative basis; however, just several months into construction the team received a commitment from the food services and facilities maintenance supplier. The property is nearing completion and the tenant will take occupancy in early 2020.

Market Outlook Bright

Unlike other market sectors, where demand can fluctuate rapidly, the market for high–quality distribution space is extremely deep and growing.

Ellison Patten

New direct-to-customer consumption patterns have pushed national retailers like Lowe’s, Jofran, Amazon, Wayfair, Albertsons and Walmart to hunt for over a combined 4 million square feet locally. The proliferation of food delivery programs, whether meal kits or more traditional bundled groceries, has bolstered demand for cold and refrigerated storage.

Meanwhile non-traditional warehouse uses, including breweries, fitness and training studios and self-storage, are now also competing for warehouse space. The demand drivers for warehouse are tremendously diverse and promoting strong market fundamentals and a bright outlook.

Ethan Robert is director of research at Lincoln Property Co. and Ellison Patten is a senior vice president.

|

|