Boston-based Camber Development recently acquired $200 million of flex and R&D properties in eastern Massachusetts including 160 Dascomb Road in Andover, which is anchored by a Lockheed Martin clean tech battery division. Photo courtesy of Camber Development

While Massachusetts’ continuing life science expansion has prompted dozens of commercial developers to shift their focus to lab projects, others see overlooked opportunities in the industrial market’s R&D and flex space.

One recent upstart, Boston-based Camber Development, has acquired $200 million worth of R&D properties in the suburbs since its founding in late 2020. In a joint venture with Wheelock Street Capital, which has allocated $500 million from a pair of its funds, Camber is in the market for approximately $800 million in additional local acquisitions.

Its investment strategy reflects the increasingly crowded life science market with its record-setting prices for lab properties, making flex and R&D buildings stand out as one of the few remaining bargains in Greater Boston commercial real estate.

“We’re trying to find a differentiated approach in a different niche, unlike many developers who said they’re going to do urban life science from day one and try to go head-to-head with the big players,” said David Wilkinson, a former Tishman Speyer executive and now managing director of Camber Development.

Founded in October by former National Development executive Tucker Kelton, Camber Development has acquired 12 properties occupied by tenants including Lockheed Martin, Sanofi Genzyme and others in growing industries ranging from robotics to medical devices and biomanufacturing.

Flex properties occupy an overlooked niche within the industrial real estate market, where many developers are racing to build high-bay warehouse and distribution space for e-commerce companies. Typically a mix of single-story and high-bay space, flex properties usually contain office, research, manufacturing and warehouse areas for a single company or multiple tenants, and 18- to 24-foot clear heights.

Flex properties occupy an overlooked niche within the industrial real estate market, where many developers are racing to build high-bay warehouse and distribution space for e-commerce companies. Typically a mix of single-story and high-bay space, flex properties usually contain office, research, manufacturing and warehouse areas for a single company or multiple tenants, and 18- to 24-foot clear heights.

Camber is betting that continuing growth in the manufacturing, logistics and life science industries will translate into leasing momentum for its 1.2 million-square-foot portfolio. Its three-building, 311,000-square-foot Ballardvale Road portfolio in Wilmington exemplifies the target industry mix, with buildings occupied by Locus Robotics, Spectra Medical Devices and Charles River Laboratories.

Signs of Increasing Price Pressure

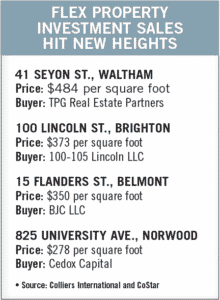

Competition from life science and e-commerce developers for suburban sites is starting to push flex property prices higher, however, amid limited inventory of development sites in eastern Massachusetts. Some flex properties have been sold in recent months for over $400 per square foot, indicating that investors are looking for alternatives to traditional office buildings amid the continuing COVID crisis.

Little ground-up flex development has taken place in recent years, and the Greater Boston inventory actually declined from 2020 to 2021 as flex properties were converted into other uses, said Aaron Jodka, national director of capital markets research for Colliers International.

“This is not like the industrial distribution market, where you’re seeing a wave of speculative development,” Jodka said.

Steve Adams

Colliers data shows four recent transactions topping $350 per square foot for flex properties in Greater Boston, rivaling prices for traditionally higher-renting uses such as office space.

Through its Alloy life science platform, TPG Real Estate Partners acquired a 600,000-square-foot Waltham portfolio in December 2020 for $340 million, including a former Raytheon Corp. R&D and manufacturing facility at 41 Seyon St. Cambridge-based Generation Bio leased 104,000 square feet in July, with plans to build out the space for biomanufacturing.

The market is strongest north of Boston, where remnants of the personal computing industry left behind low-rise R&D facilities now sought by robotics, artificial intelligence and advanced manufacturing tenants, Jodka said.

“It’s a covered land play where you can demolish it later for a potential conversion,” Jodka said. “If you look around Greater Boston, there’s a limited amount of land and sometimes these flex buildings are on sites that developers want. They are paying for the land and the future uses, not necessarily the current uses.”

|

|