Historic flooding in February 2018 in the Seaport and Long Wharf (pictured). Photo by John Centrino | Shutterstock

The Federal Reserve has added a discussion about climate change to its Financial Stability Report for the first time, noting vulnerabilities the financial system could face in the years ahead.

The 80-page report is a supplement to the Fed’s annual report to the Financial Stability Oversight Council and is meant to promote public understanding of the Fed’s views on financial stability, according to the report released yesterday.

Including the Fed’s views on climate change was a welcome addition to the report, Fed Governor Lael Brainard said in a statement.

“It is vitally important to move from the recognition that climate change poses significant financial stability risks to the stage where the quantitative implications of those risks are appropriately assessed and addressed,” Brainard said.

The Fed said in the report that it has only just started to incorporate the effects of rising global temperatures, including changing sea levels and more severe weather events, into its analysis of financial stability.

Both direct losses from events like storms and droughts, as well as repricing events related to the public’s perception of climate-related risks, could affect economic conditions and the value of financial assets, the Fed said.

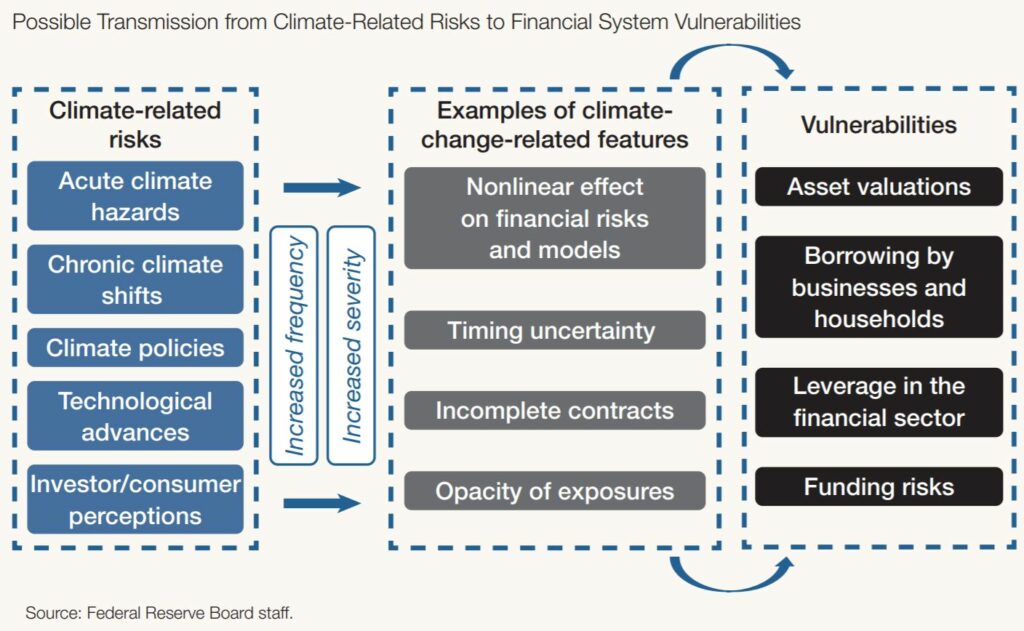

“These repricing events and direct losses associated with climate hazards can result in an increased frequency and severity of financial shocks; the timing and repercussions of these shocks are difficult to predict in advance,” the Fed said.

In its two-page discussion on climate change, the Fed pointed to real estate exposures as an example of how climate change could increase financial stability risks. More frequent floods or storm surges could cause the expected value of real estate to decrease, which could also “pose risks to real estate loans, mortgage-backed securities, the holders of these loans and securities, and the profitability of nonfinancial firms using such properties.”

“With perfect information, the price of real-estate-linked assets and the valuations of claims linked to such assets – held by banks, insurers, investment funds, and nonfinancial firms – would already reflect these climate-related risks,” the Fed said. “However, given the uncertain timing and severity of future climate-related flooding and the associated opacity of asset exposures, investors in real-estate-linked assets may react abruptly to new information about a region’s exposure to climate-related financial risks.”

Federal Reserve’s depiction of the possible transmission from climate-related risks to financial system vulnerabilities

Several policies could help moderate the effect of climate change on financial stability, including increased transparency related to disclosure and measurement of climate risks, which could then reduce the likelihood of sudden changes in asset prices.

More research into the connections between climate, the economy and the financial sector could also make pricing more efficient, the Fed said, adding that policies beyond the financial system related to adapting to or mitigating the effects of climate change could also bring about more stability.

“The Federal Reserve is evaluating and investing in ways to deepen its understanding of the full scope of implications of climate change for markets, financial exposures, and interconnections between markets and financial institutions,” the Fed said. “It will monitor and assess the financial system for vulnerabilities related to climate change through its financial stability framework.”

Brainard in her statement pointed out the the importance of increased disclosures and standardized measurements related to climate risks.

“Supervisors expect banks to have systems in place that appropriately identify, measure, control, and monitor their material risks, which for many banks is likely to extend to climate risks,” Brainard said. “At present, financial markets face challenges in analyzing and pricing climate risks, and financial models may lack the necessary geographic granularity or appropriate horizons.”

|

|