Homebuyers looking to retire early or work remotely from more bucolic surroundings continued to flood Cape Cod and some South Shore towns this spring, pushing median sale prices to astounding heights.

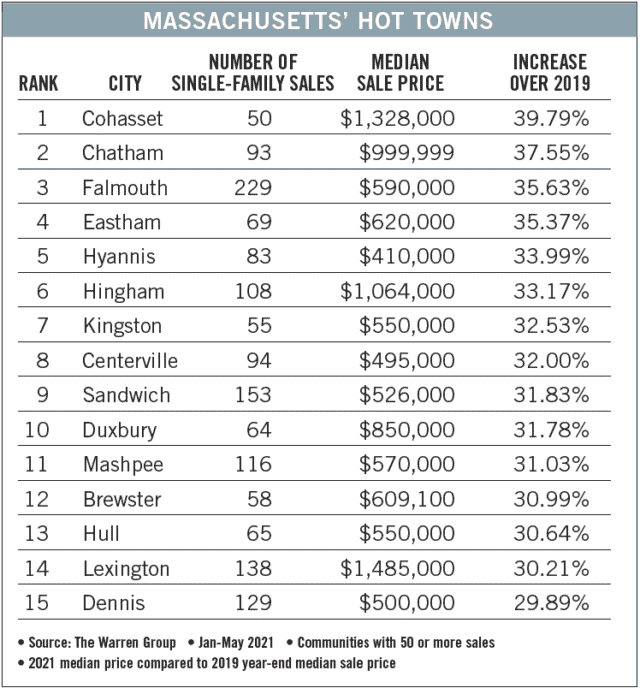

Chatham ended May with a year-to-date median sale price of just under $1 million, 37.55 percent higher than its year-end median sale price in 2019, according to The Warren Group, publisher of Banker & Tradesman.

Falmouth saw a similar surge over the same time period: 229 homes sold at a median price of $590,00, up 35.63 percent from year-end 2019.

Even communities like Sandwich and Mashpee, typically out of the limelight and havens for Cape Cod’s middle- and working-class homebuyers, saw dramatic leaps in median price: 31.83 percent in the former and 31.03 percent in the latter.

“It’s unreal how tight the market is,” said Greg Kiely, managing broker for Sotheby’s International Realty’s Cape Cod brokerages.

WFH, Retirees Powered Demand

Unlike mid-2020, where the Cape saw a rush of buyers desperate to escape the perceived greater threat of COVID-19 in urban areas, many of this spring’s house-hunters were looking to swap their current homes for ones closer to the beach life they’d always dreamed of.

“People were saying to themselves: ‘You know what? I’ve proven I can work from home for 15 months. I think I should do this permanently,’” said Richard Waystack, executive broker at Jack Conway & Co.’s Harwich office.

A part of this new set of work-from-home buyers overlaps with the retiree buyers the Cape traditionally attracts, Waystack said, thanks to empty-nesters’ ability to uproot themselves without having to worry about children still in school. Many of these buyers were targeting homes priced between $500,000 and $1 million.

“We got a lot of empty-nesters, people who were going to buy in five years, but now that they can work from home they’re getting into the market sooner,” said Natalia Weiner, a sales associate at Gibson Sotheby’s International Realty’s Harwich Port offices.

The Cape’s historically lower prices helped amp up the area’s appeal, she said. Interest rates were another key driver that helped some buyers keep up in bidding wars or afford bigger and better properties than they might have been able to in other Massachusetts markets.

Where Is the Inventory?

The result has been a feeding frenzy across all price points.

“Everything is selling. If anything is on for more than a week and a half, buyers are asking what’s wrong with it,” said Mari Sennott, a Sandwich-based agent with Today Real Estate.

Year-to-date through June 30, Barnstable County had seen nearly 10 percent fewer new single-family listings hit the market, according to the Cape Cod & Islands Association of Realtors, with 63 percent fewer houses for sale in June alone.

Despite the return to a semblance of normalcy in Massachusetts over the last few months, much of the “organic” sources of inventory – move-up buyers and buyers downsizing or going into retirement homes – did not materialize this spring.

“The places that came on were people who were taking opportunities to capitalize on the prices or because life forced them to,” Kiely said.

As prices surged, that created difficulties for buyers seeking financing, said Cape Cod Five sales manager Kimberly Geary. Many offers crossed her loan officers’ desks where the home inspection or mortgage contingencies had been waived. In some cases, buyers had added demands.

“They wanted to make sure maybe if the appraisal isn’t coming in [at the sale price], they wanted to be sure that the buyer could pay cash,” she said. “Then you had people tapping into their retirement accounts and investments [to pay the difference] and saying, ‘Can you give me delayed financing?’ Once they bought, we’d immediately put in a refinancing so they could recoup the money.”

Thanks to numerous luxury sales, Chatham saw Cape Cod’s biggest jump in its median single-family sale price over pre-pandemic levels, at 37.55 percent.

Cape Workforce Squeezed

But with much of the Cape’s existing inventory eaten up by buyers last year mad to find a home at the lowest mortgage interest rates on record, many of these off-Cape buyers found themselves looking at neighborhoods not often considered vacation home territory.

“If people are piling onto the Cape to move here … they have to go to the Yarmouths, the Mashpees, the Denises,” Kiely said.

With easy highway access to Boston for the few days each week owners may have to be in the office, Sennott said Sandwich has proved popular.

“I just got a new buyer yesterday. She’s working at a firm based in New York, with an office in Boston. She’s 100 percent remote; now she’s going to be going into the office one or two days [each week],” she said.

Proximity to Boston helped boost towns on the South Shore, too, said Maureen Barry, manager of Jack Conway & Co.’s Hull and Marshfield brokerages. Even Hull saw its median sale price jump by 30.64 percent, thanks in part to downsizers moving in from Hingham and Cohasset.

“Once they found out they could work from home, they had no problem finding a house quite some distance from the city,” she said.

But with off-Cape buyers beating a path to the communities that largely attracted local buyers who work in the area, both first-time and move-up buyers found themselves shut out, Kiely said. And even mortgage interest rates hovering around 3 percent aren’t able to help them beat out other bidders.

“If you needed a mortgage, you probably weren’t winning the offer,” he said.

Future Still in Motion

The single-family market’s froth dissipated somewhat as spring turned to summer, thanks to more than a few buyers deciding to take the summer off, frustrated at being unable to win bidding war after bidding war.

James Sanna

“Two to three months ago we were standing in lines for open houses. That has stopped,” Sennott said. “We’re still seeing multiple offers. We might not be seeing 30 offers but we’re seeing four, five, and we’re seeing them in a week instead of an hour.”

This could offer some local first-time buyers a chance to bid on homes without worrying as much about deeper-pocketed competitors, Kiley said.

The pace of new listings and sales this fall will offer an indication of whether the 2020 and spring 2021 markets ultimately prove an aberration, Kiley said, and significant questions remain. Will the liberal work-from-home policies that unshackled many new Cape buyers from their daily commutes stay in place at many companies through the fall? If they don’t, or if companies reduce their remote-only workers’ salaries, how will the area’s new arrivals react? And will some sellers decide not to list if the pace of price increases and sales records slows?

“Is this a temporary shift? Everything in real estate is temporary,” Barry said, laughing. “We have to be very aware. Our job as Realtors is to make our buyers aware of what’s going on in the market. … What I’m telling people is: Put an exciting price on your house. The market will tell you what your house is worth.”

|

|