The maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac will increase by 18 percent in 2022, with the limit for two Massachusetts counties approaching $1 million.

The Federal Housing Finance Agency said in a statement that the loan limit for one-unit properties will increase from $548,250 in 2021 to $647,200 in 2022.

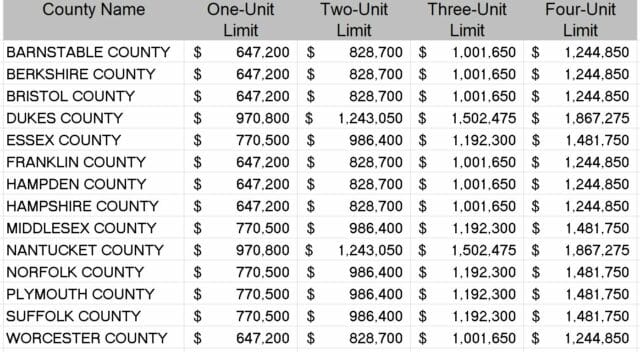

Because of median home values, several counties in Eastern Massachusetts will have higher limits.

The FHFA adjusts the conforming loan limit annually to reflect the change in the average U.S. home price, as required by the Housing and Economic Recovery Act. Conforming loan limits had remained stagnant for a decade, but since 2016, the limit has increased each year.

The baseline maximum conforming loan limit in 2022 will increase by the same percentage as the FHFA’s estimated housing price increase. Using its third quarter 2021 House Price Index report, the FHFA calculated the increase based on estimates of the average U.S. home value over the last four quarters. According to FHFA’s seasonally adjusted data, house prices increased 18.05 percent between the third quarters of 2020 and 2021.

Because of rising home values, almost every U.S. county will see an increase in conforming loan limits, the FHFA said. Conforming loans in half of Massachusetts’ counties will be subject to the new $647,200 limit. The other half will have higher maximum limits because 115 percent of the local median home value exceeds the baseline limit.

Both Dukes and Nantucket counties will qualify for the maximum limit of $970,800 on one-unit properties, up from $822,375 in 2021. HERA limits the maximum conforming loan ceiling to 150 percent of the baseline.

Essex, Middlesex, Norfolk, Plymouth and Suffolk counties will have a conforming loan limit in 2022 of $770,500. The 2021 limit in these counties is $724,500.

Conforming mortgages financed by government-sponsored entities and the FHFA are the most lenient, allowing eligible first-time homebuyers to put down as little as 3 to 5 percent in some cases. Jumbo loans, on the other hand, require borrowers to have higher FICO scores and larger down payments, and also come with asset and reserve requirements.

In a separate statement, FHFA Acting Director Sandra L. Thompson pointed to counties that now have conforming loan limits close to $1 million and said the FHFA is evaluating how loan limits are calculated.

“Compared to previous years, the 2022 Conforming Loan Limits represent a significant increase due to the historic house price appreciation over the last year,” Thompson said. “While 95 percent of U.S. counties will be subject to the new baseline limit of $647,200, approximately 100 counties will have conforming loan limits approaching $1 million. FHFA is actively evaluating the relationship between house price growth and conforming loan limits, particularly as they relate to creating affordable and sustainable homeownership opportunities across all communities.”

UPDATED 1:05 p.m., Nov. 30, 2021: This story has been updated to include a statement from the FHFA acting director.

|

|