Middle-class families in Massachusetts are falling further and further behind the wealthy in just about everything, from wage gains to access to the best health care.

Now you can add another big item to that list – real estate values.

Home prices in middle- and working-class towns across the Boston area have been on the rise lately as they finally start to shake off the aftereffects of the Great Recession.

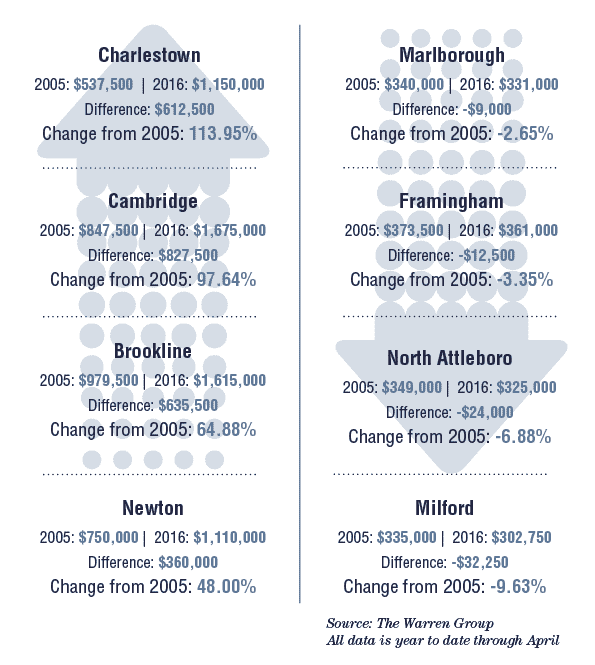

Towns ranging from Weymouth on the South Shore to Marlborough on I-495 have seen home prices rise steeply over the past year, in some cases by double digits, according to data from The Warren Group, publisher of Banker & Tradesman. Yet while wealthy communities like Newton and Cambridge have been shattering price record after price record, many middle- and blue-collar towns are still struggling to catch up to where prices were a decade ago before the global economy took a dive.

Struggling To Catch Up

Middle-class towns and suburbs across the Boston area have posted big gains in home prices over the past year, with a number seeing double-digit increases.

The gains come after a relatively sluggish recovery in values in the years following the Great Recession in many of these towns, particularly those in the outer suburbs along 495.

Certainly the economy has picked up compared to where it was back in 2009, while rising prices in Boston and the inner suburbs are pushing buyers farther out as well.

Scott Van Voorhis

Milford, Marlborough, Ayer, Stoughton, Revere, Weymouth, Kingston, North Attleboro and Carver all left the $200,000s behind over the past year as their median prices rose into the $300,000s. Home prices in Framingham, Dedham, Malden, Mansfield, Peabody, Hull, Chelmsford, Tyngsboro Saugus and Tewksbury have all pushed into the upper $300,000s. And a number of other communities, including Woburn, Franklin and Braintree have seen median home prices rise into the $400,000s, according to data from The Warren Group.

Yet even with these gains, home prices in many of these towns are still under their peak from more than a decade ago.

The median home price in Milford, for example, is now $302,000, after a 12 percent rise over last year’s median. But it will take at least another year of double-digit growth before the median price is back to where it was during the first four months of 2005, when it was $335,000.

Framingham enjoyed a 9 percent bump in its median price over last year, but at $361,000, it’s still $12,000 below where it was in 2005. For its part, Marlborough’s median price jumped nearly 16 percent, to $331,000, but it is still below its 2005 number of $340,000. Ditto for North Attleboro, which, despite a 21 percent increase over last year, the median is still roughly $24,000 below where it was 11 years ago, when it was nearly $350,000.

Other towns in the market’s broad middle are closer to their last peak or have even pushed past it a bit. Norwood, at $395,000, is just $5,000 below where it was this time back in 2005.

Meanwhile, Franklin and Dedham have posted some real gains. Franklin’s median price hit $412,750 at the end of April. That 12 percent increase pushed it well above its 2005 median of $365,450. The same for Dedham, which at $413,000, is a good $28,000 from where it was more than decade ago.

Yet what’s happening in the Boston’s area’s most expensive towns and suburbs makes even the solid gains seen in Franklin and Dedham look like chump change.

The Great Recession was more of a speed bump for home prices in Cambridge than anything else. The median home price has nearly doubled to $1.6 million over the past decade in the ivy-clad life sciences hub, up from $847,500 back in April 2005.

Newton’s median price is now over $1.1 million, compared to $750,000 a decade ago, while Lexington is now approaching the $1 million mark, a big jump up from its $690,000 median in 2005. Winchester has seen its median price rise roughly 30 percent over its last peak, hitting $908,000, while Charlestown has definitely left those “Good Will Hunting” days behind, having blown past the $1.1 million mark. Back in 2005 it was $537,500.

And I would be remiss if I didn’t mention Brookline’s meteoric gains, undoubtedly helped by a spate of mansions built by John Henry, Tom Brady and the Krafts. Back in 2005, the town’s median price was a shade below $980,000 while today it tops $1.6 million.

The contrast between skyrocketing home values in the brand-name cities and towns and the until recently sluggish growth seen in many middle-class communities only further highlights the growing wealth divide.

For the wealthy who can afford homes in the $1 million and up range, these price gains are gravy, coming atop handsome returns on well-stocked portfolios. But for most middle-class families, home prices and values are serious business, with real estate by far the biggest investment. And while the recent gains are great for homeowners who bought a decade ago and have hung on, they come relatively late in the real estate cycle.

Frankly, we’d be lucky to get a couple more years out of the current bull market in real estate. And for more than a few middle-class families whose home values have yet to get back to the starting line, it’s just another example of how life is more fair for the rich.

|

|