The pandemic hit the mortgage sector – like most industries – with a series of unknowns: Can the industry operate remotely and still comply with regulations? Will credit standards tighten? Will there even be any activity?

Most concerns were quickly resolved as the industry not only adapted to the pandemic but found homeowners seeing opportunities to refinance with historically low mortgage interest rates. Loan originators who have focused on maintaining relationships with and acting as advisers for their customers have been able to take advantage of the low-rate environment.

“If they’ve created that positive customer experience the first-time through, then when borrowers look to refinance, their first call is usually to the individual they worked with the last time,” said William Parent, president and CEO of Envision Bank. “The really good mortgage loan originators have always been good advisers.”

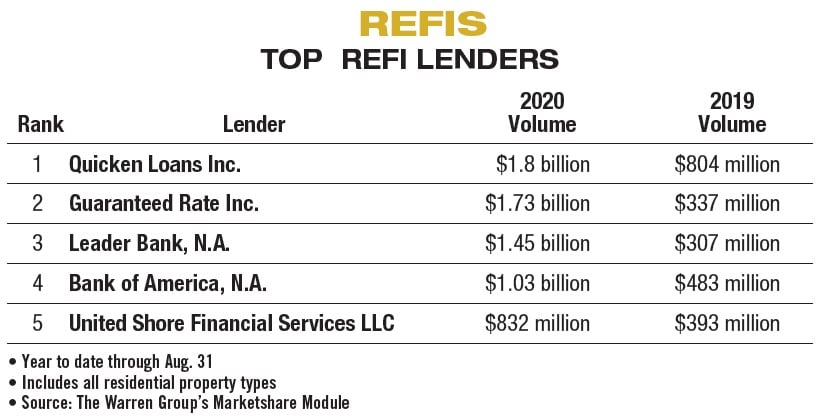

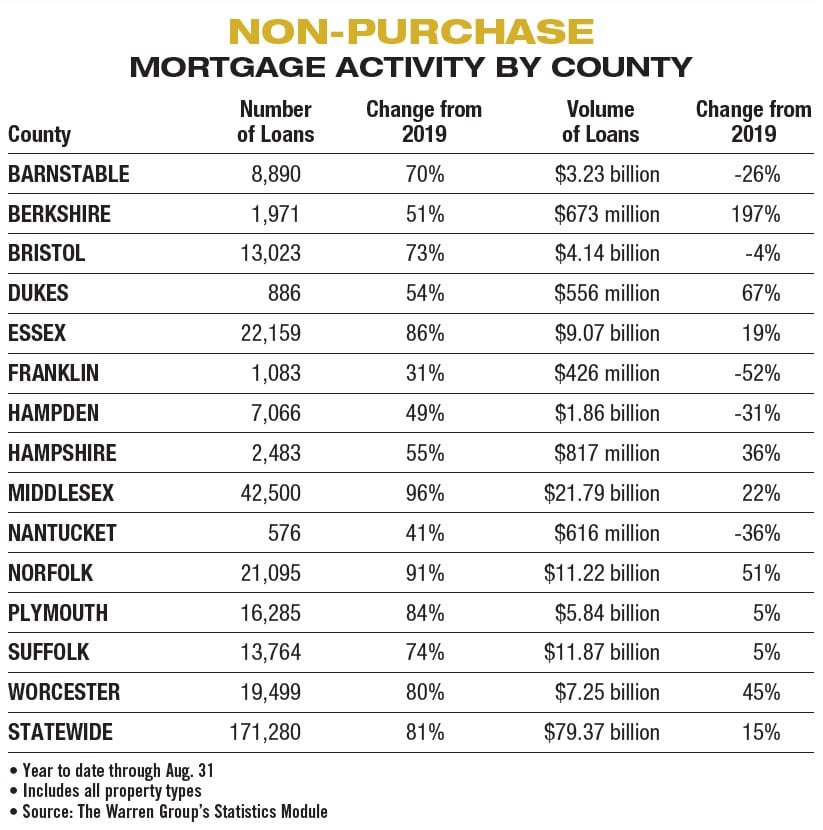

Massachusetts had $37.4 billion in residential refinance activity during the first six months of 2020, a 177 percent increase over the same time period in 2019, which saw about $13.5 billion in residential refinances, according to The Warren Group, publisher of Banker & Tradesman.

Interest rates had started 2019 off more than a point higher than what borrowers would find a year-and-a-half later. The average interest rate in January 2019 on a 30-year, fixed-rate mortgage was 4.51 percent, according to Freddie Mac, while the average rate for a 15-year, fixed-rate loan at the start of 2019 was 3.99 percent

By January 2020, the average interest rate on a 30-year, fixed-rate mortgage was 3.72 percent and six months later was at 3.07 percent. The average rate for a 15-year, fixed-rate loan slid from 3.16 percent in January 2020 to 2.56 percent in June.

Low Rates Accelerated Loan Volume

Before the pandemic, Shant Banosian, a senior vice president at Guaranteed Rate, expected that low rates and a good economy could drive him to originate close to $1 billion in mortgage activity in 2020. Instead, Banosian reached that milestone last month, according to Guaranteed Rate. He’s expecting to do an additional $500 million by year’s end.

The start of the pandemic did raise questions about the direction the industry would take.

“When everything hit, I admittedly got nervous because I wasn’t sure what would happen to the economy. Would joblessness increase?” Banosian said. “The stock market came down, and I wasn’t sure if people were going to be buying houses.”

People have indeed been buying houses, with record levels of demand sending home prices soaring. And if they haven’t tried to land a new home given low housing inventories, Banosian said, they have at least begun to reconsider their living arrangements. Telecommuting has changed how people think about where they want to live and the type of house they have, he said, adding that some renters with the means have been moving toward homeownership as well.

“They’re redesigning their lifestyle and reevaluating where they want to live, redesigning the type of houses they want and really just reevaluating what’s important to them,” Banosian said. “Your house has become so much more important, and what you want in it is really more important as well.”

By staying in touch with customers using direct channels like phone calls, loan originators were able to build an advisory relationship that culminated in securing their business when low mortgage interest rates created intense customer interest in mortgage refinancing.

Staying in Touch Key

While loan originators like Banosian normally focus on purchase activity and bringing on new clients through referrals from agents in the real estate industry, the pandemic has provided an opportunity to work on refinancing mortgages for existing customers.

Staying in touch with customers has been key to Banosian’s business. Clients receive semi-annual reviews, and Banosian and his team use different platforms – phone calls, text messages, emails and social media – to reach out to clients.

The quality of the content he shares, including on social media, is important as well, Banosian said. He said he stays on top of industry news to keep his clients informed, especially those who might not follow or understand the mortgage market.

To handle the outreach and the refinance volumes this year, having enough staff was also critical, he said. Because Banosian had anticipated that 2020 would see strong refinance activity he staffed properly for the year.

Loan Originators as Advisers

Envision Bank had invested in its mortgage operations in the years leading up to the pandemic, including by acquiring First Eastern Mortgage Corp. in 2016, said Parent, who joined Envision shortly after the pandemic started. The bank now has loan officers across Massachusetts and did more than $450 million in refinancing activity during the first six months of 2020, according to The Warren Group.

Loan originators have benefited during the pandemic from having an advisory relationship with homeowners, Parent said, as customers have been reaching out to their original loan originator, and originators have been calling customers to discuss ways to lower mortgage payments in the current interest rate environment.

The pandemic has also brought challenges for loan originators, who need to have a comprehensive picture of the borrower’s credit position before refinancing, Parent said. Verifying income for sole proprietors and the state’s high unemployment rates have been just a few of the challenges loan originators have faced.

Diane McLauglin

As employment levels improve, Parent expects refinance activity to continue as more homeowners meet the standards for refinancing while interest rates remain low.

Even as refinancing has dominated mortgage activity this year, preparing for future purchase markets is still key for loan originators.

“For those that are larger mortgage players, this is a time to perform and get your share, and hopefully a little more, while keeping an eye on how you continue to service the purchase market too,” Parent said. “Because that’s what’s there irrespective of where interest rates are, and you want to make sure that you’re really strong in capturing purchase volume versus just refinancing volume.”

|

|