Wynn Resorts’ glittering, $2.6 billion resort opened to good reviews on June 23, and may yet kick off more development in its vicinity. Photo courtesy of Wynn Resorts | Michael Blanchard Photography

The long-awaited Boston “resort” casino opened to not so favorable reviews the other weekend at Suffolk Downs.

“‘Blahh!’ Casino Opening Leaves Gamblers Bummed,” the front-page of the Boston Herald screamed.

Critics panned the cavernous, slot-machine packed hall in East Boston as a cheap copy of Connecticut’s once proud Mohegan Sun.

But over at dingy and decrepit Fenway Park, Sox fans weren’t much happier, with fans throwing beer cans onto the field after a 20-0 loss to the Orioles, adding to a 24-game losing streak that, yet again, will keep the Sox from breaking the Curse of the Bambino.

That clearly didn’t happen on June 23, but it might have, if a group of local insiders won out in two of the biggest deals of the new century: The epic, $700 million-plus bidding war for the Red Sox in 2001 and the coveted state license awarded in 2014 to build a Boston-area resort casino.

Instead of locals, outsiders like billionaire hedge fund king John Henry and Las Vegas icon Wynn Resorts were the ones who won out in knock-down fights for two of the most transformative deals in the history of Greater Boston.

And they hit both of them out of the park, restoring the Red Sox and Fenway Park and building one of the most opulent casino resorts ever seen east of the Mississippi.

Improbable Beginnings

It all began in 2001, when Henry, at that time a somewhat obscure investment mogul from Florida, teamed up West Coast TV producer Tom Werner, of “The Cosby Show” and other hits, to make a bid to buy the Boston Red Sox.

Henry and Co. beat out a group of local heavyweights led by concessions king Joseph O’Donnell and Newton developer Steve Karp, who had made a fortune building upscale malls around the country.

It was a stunning rejection of the local favorites, who were close to both the late Boston Mayor Thomas M. Menino, known for his iron grip over the city’s development and business scene, and Attorney General Thomas Reilly, who promptly launched an investigation into the bidding process.

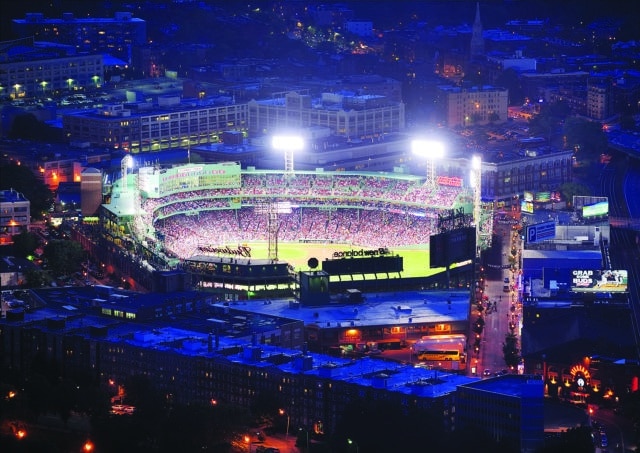

“Boston, Massachusetts, USA – June 20, 2011: Fenway Park stadium aerial view at night illuminated by lights with base ball game going on.”

But it was not Menino who in the end called the shots, but rather former MLB Commissioner Bud Selig. And he clearly favored Henry, a fellow baseball guy who was wrapping up a stint as owner of the Marlins.

It still seems amazing even now, but Henry and his fellow outsiders fulfilled their bold pledge from December 2001 to win several World Series titles.

Key to the Red Sox’s resurrection was the Henry gang’s counterintuitive decision to reclaim Fenway from the wrecking ball and restore it to its quaint, early 1900s glory, while also turning it into one of baseball’s biggest cash cows.

The decision also unleashed a major building boom around the park that saw more new condo and apartment towers go up than almost any other neighborhood in Boston

I am not so sure the local guys could have achieved the same level of success.

As I dogged the Red Sox sale story at the Herald while it unfolded over nearly two years, they seemed confident they could leverage their relationship with Menino to build a new ballpark next to South Station or somewhere else in the city.

Instead of winning championships, Henry’s rival bidders for the Red Sox would likely have spent years battling to get permits for a new ballpark while also having defend what would have been a heart-wrenching decision to tear down Fenway and redevelop the site.

It’s also not clear that the locals had pockets deep enough to keep the Sox competitive.

At least one principal privately argued the team should have a payroll more in line with the scrappy but perpetually money-starved Oakland As than the champion New York Yankees.

History Repeats Itself – Sort of

The coda to the sale of the Red Sox played out roughly a decade later with a competition for the state license to build a Boston area casino in 2014.

O’Donnell, the leading member of that band of locals that had tried and failed to buy the Sox, also happened to be a major investor in Suffolk Downs along with his old development buddy and fellow Red Sox bidder Karp. They teamed up first with Caesars Entertainment and then later with Mohegan Sun to make a run at the Boston area casino license.

Steve Crosby, the state Gaming Commission chairman, said he was looking for proposals that would meet the “wow” criteria, and Wynn Resorts’ glittering proposal apparently fit that requirement.

Supporters of the Suffolk/Mohegan bid felt they were treated unfairly, and before long the commission was hit with various lawsuits arguing the fix had been in for Wynn.

Scott Van Voorhis

If the Gaming Commission had known of the sexual abuse allegations against Steve Wynn back in 2014, its decision would have likely been much different.

Yet with the $2.6 billion Encore Boston Harbor having opened to deservedly rave reviews, it’s hard to argue the commission made the wrong choice in choosing Wynn Resorts with the information they had available.

While the locals may have known all the right people, as with the Red Sox bid, they were probably in over their heads, financially and otherwise.

Sometimes, it takes an outsider or two to shake things up and help a clubby place like Boston win big.

Scott Van Voorhis is Banker & Tradesman’s columnist; opinions expressed are his own. He may be reached at sbvanvoorhis@hotmail.com.

|

|