Reverse mortgage lenders are giving those loans an image makeover in the hopes of reversing their years-long declining sales trend.

Home Equity Conversion Mortgages (HECMs), also known as reverse mortgages, have been around for decades, but they became popular when fast-rising home values gave struggling seniors a new source of funds. Popularity turned to infamy when those funds dried up and it became clear that many reverse mortgage clients were ill-informed about how they worked, resulting in foreclosed senior citizens making national news.

The Massachusetts Division of Banks maintains a list of approved HECM lenders with only 18 lenders listed, including two local banks. Below that list is a list of another 25 lenders that used to be approved, but no longer offer the product.

“The government’s HECM, or reverse mortgage program, was designed in a different economic time,” according to a statement from Wells Fargo, which stopped selling HEMCs in 2011.

The industry insists that things are different now. Lenders say reverse mortgages are making a comeback as a sound portion of good financial planning – when used appropriately.

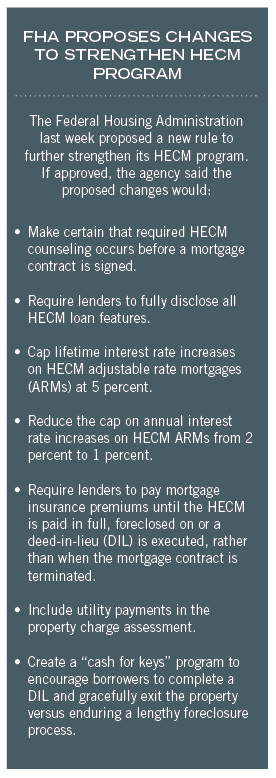

Recent changes in federal regulations that made it harder to qualify, mandated third-party financial counseling for HECM applicants, provide non-borrowing spouse protections and limited HECMs to 60 percent of the equity in the home all combine to make it a much safer product for seniors, according to Ed Barrett, vice president and senior loan officer at Salem Five, who specializes in reverse mortgages.

Recent changes in federal regulations that made it harder to qualify, mandated third-party financial counseling for HECM applicants, provide non-borrowing spouse protections and limited HECMs to 60 percent of the equity in the home all combine to make it a much safer product for seniors, according to Ed Barrett, vice president and senior loan officer at Salem Five, who specializes in reverse mortgages.

“I think these changes are having positive results,” Barrett said. “It has been picked up on by the mainstream press as a move in the right direction. We see a lot more mainstream acceptance within the financial planner community. Very few programs can offer the flexibility and access of a reverse mortgage.”

Retiring Earlier, Living Longer

According to National Reverse Mortgage Lenders Association, 30 percent of Americans over the age of 55 have no retirement savings and 26 percent have less than $50,000 saved. Lenders say reverse mortgages can augment many seniors’ retirement plans.

A decade ago, the average age of a HECM borrower was 74; today, the average age is 70. People are living longer and are eligible for a reverse mortgage as young as 62, and it’s important to make the money last, Barrett said. As an example of appropriate use, Barrett said a reverse mortgage line of credit could be a pool to draw from when other investment performances drop off. When those other investments recover, a borrower can repay the loan without penalty.

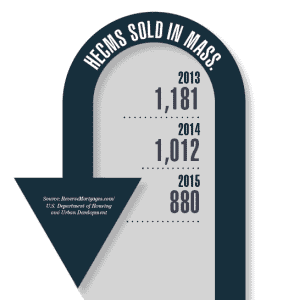

The number of HECMs sold in Massachusetts is declining, in part because recent federal regulations made them harder to get. National reverse mortgage lender ReverseMortgages.com reports, per information from the U.S. Department of Housing and Urban Development, that in 2013 there were 1,181 reverse mortgages in Massachusetts. In 2014, there were 1,012. Last year, 880 HECMs were sold.

“Things are getting busier,” Barrett said. “We’re seeing a lot more thirst for knowledge out there. We want to maintain the message that information is power. The more facts you have, the easier your decisions are.”

Required counseling for borrowers prior to application has resulted in much more informed consumers, he said, but HECMs aren’t right for everyone – when he thinks there’s a better option for a customer, he refers them to a colleague.

“We take a holistic approach in terms of analyzing a borrower’s options,” Barrett said. “There are circumstances where a HELOC is a better tool for a borrower. A lot of people have HELOCs, which work well for them for 10 years and when the payment recasts to principal and interest, they refinance into a reverse mortgage, which provides access to additional equity.”

A recent survey from the Center for Human Resource Research at Ohio State University, “Aging in Place,” listed the top five reasons people say they obtain an HECM:

A recent survey from the Center for Human Resource Research at Ohio State University, “Aging in Place,” listed the top five reasons people say they obtain an HECM:

- To cover everyday expenses.

- To pay off mortgage.

- To pay off non-mortgage debt.

- To make home improvements.

- To provide financial help to family.

Barrett sees HECMs not just as a loan of last resort for struggling seniors, but a tool that financial planners are increasingly using as part of their clients’ retirement plans.

“People are living longer and there is a tremendous amount of senior citizen home equity,” Barrett said. “The challenge is that life gets more expensive over time and accumulated home equity has no functional utility. The reverse mortgage creates a functional utility.”

The Court Of Public Opinion

The HECM industry is still maturing, but changes implemented over the last couple of years have made it “a much better product,” said Chris Grevelis, reverse mortgage officer at East Boston Savings Bank; he noted particularly the cap of $625,000 and not more than 60 percent of the available equity.

“When I started 10 years ago, you’d sit down with a prospect and tell them you’re giving them $200,000 and they don’t have to pay it back in their lifetime,” Grevelis said. “People lost control and spent the money. Human nature being what it is, people are going to find a way to get to the money no matter what, if that’s what they want. People think it’s too good to be true.”

Borrowers took out the highest loan amount for which they qualified, he said, and either spent the money too quickly, or invested it in another vehicle that didn’t always do well. When they ran out of cash and couldn’t pay their taxes, the lender would foreclose, and public opinion of HECMs took a nosedive.

“It is a great program, a safe program. The bad reputation was earned 40, 50 years ago,” Grevelis said. “When it first came out it wasn’t well-regulated. It wasn’t the product that was bad, it was the person selling the product was bad, but when the FHA designed it with AARP, they created something very safe for the borrower.”

Grevelis said some people who come to him erroneously think the bank will get the title to their home or that they won’t have any equity left to leave to their kids, but when he shows them an amortization table, they’re pleasantly surprised.

“It’s turned into an extremely flexible product, Grevelis said. “It’s not just a product of desperation anymore. In the last six years, we’ve saved probably close to 20 families from foreclosure with a reverse mortgage.”