Thad Peterson

In about 10 years’ time, a completely new payment model built around QR codes has become the dominant payment alternative for the world’s most populous country – China. Alipay and WeChat Pay have exploded on the payments scene, and their impact is being felt well beyond China’s borders.

QR code-based payment volume may exceed traditional card-based transactions globally within 10 years. U.S. banks need to understand this new payment trend as the stakes get higher.

Because of this new payment model’s popularity in China, Aite Group conducted a survey to better understand its role in the global banking payment space. The survey was with individuals from over 20 financial organizations and though leaders actively engaged in the Chinese payment space.

Alipay and WeChat Pay have become the predominant noncash payment alternatives in China. Both companies are moving outside of China, supporting Chinese citizens in popular tourist markets and introducing their offerings in markets with similar characteristics to those of China.

Payments in China operate in a completely different ecosystem that uses QR codes and can be implemented by any merchant, whether they have a point-of-sale terminal or not. The payment technology developed in China is very quickly becoming a global phenomenon, and it has irrevocably changed the global payments space as a result.

Up to now, the two payment schemes have had little interference from the Chinese government, but they are now being forced to move to a national third-party payment platform that will also incorporate a common standard for QR codes. The growth rates of Alipay and WeChat Pay, along with the growth of QR code-driven payment schemes in other markets, make it a near certainty that the transaction volume from these schemes will exceed the volume from traditional networks.

While Alipay and WeChat Pay will continue to dominate the market, other competitors such as UnionPay now have the opportunity to compete on a more level playing field. The involvement of the Chinese government also allows the government to see and use the data being generated through the schemes. The payments world must adapt to the idea that there will be two competitive payment ecosystems on the planet and that merchants and processors will have to support both to grow or maintain their businesses.

Understanding the Chinese Mobile Payments Market

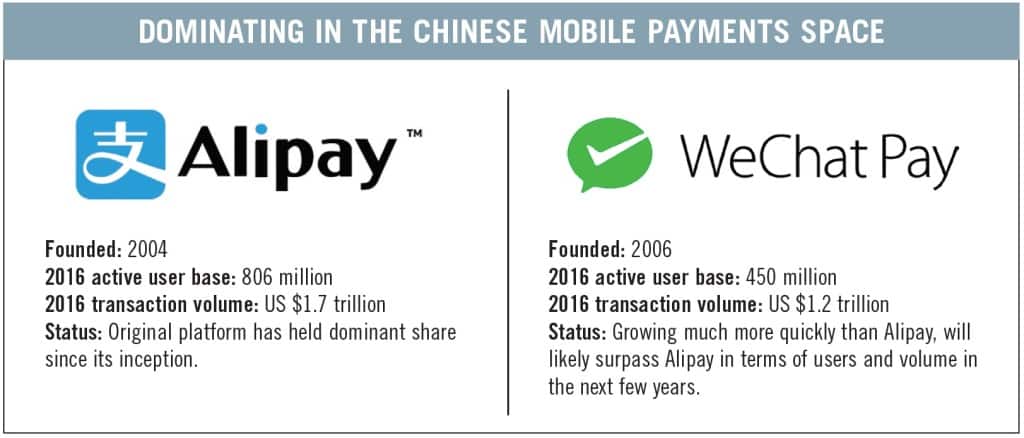

The two dominant players in the Chinese mobile payments space are Alipay and WeChat Pay. Together, the two companies control 91 percent of transaction volume. WeChat Pay leverages its ownership of the two leading chat platforms in China, QQ and WeChat. The table below highlights some key statistics:

The transaction volume for all the emerging markets could potentially surpass transaction volume in mature markets by 2022. The rapid adoption of mobile money in India and other quickly growing markets in Asia may continue to drive the explosive growth rate.

Aite Group recommends that payment processors incorporate the ability to process QR code/bar code transactions from Chinese payment platforms Alipay, WeChat Pay and UnionPay. They also recommend that processors identify markets with a high volume of Chinese tourists and work with merchants in those markets to promote acceptance of Alipay and WeChat Pay. By working with online merchants to incorporate Alipay and WeChat Pay into their shopping carts, they will gain considerable influence in the market. Payment processors must assume that both QR code-driven and traditional platforms will need to be supported in every region.

Another recommendation for networks is to build out a full QR code payment capability around the EMVCo QR code standard.

All payments ecosystem participants should adjust business strategies to address the growth and penetration of mobile money platforms that are not part of the existing payment networks.

Thad Peterson is a senior analyst at Aite Group focusing on the evolution of the payment space, the customer payment experience and merchant acquiring. To learn more about Aite Group’s research coverage of payments and customer experience, please contact Aite Group at info@aitegroup.com.

|

|