Brookline Bank’s parent company does not plan to seek out lending opportunities in New York City, even as its latest acquisition moves the bank holding company into the New York metropolitan area.

Brookline Bancorp has agreed to acquire Yorktown Heights-based PCSB Financial Corp., the parent company of PCSB Bank, in a cash and stock deal valued at approximately $313 million. PCSB Bank will operate as a separate subsidiary with a New York bank charter, giving Brookline Bancorp three banks in different states.

The transaction, which was announced Tuesday, has been unanimously approved by the boards of directors at both companies and is expected to close in the second half of 2022.

The $1.9 billion-asset PCSB Bank is located in New York’s Lower Hudson Valley and has 14 branches in Dutchess, Putnam, Rockland and Westchester counties.

During a conference call Tuesday to discuss the deal, Brookline Bancorp Chair and CEO Paul Perrault said in response to an analyst’s question that PCSB Bank might have lending opportunities in New York City through clients within its current footprint. But the acquisition “had nothing to do with New York City,” he said.

“We’ve got plenty to do in [PCSB Bank’s] existing markets,” Perrault said. “We’ve got a small market share in a very dense and deep market. … We will have our hands full, and we can prosper without going into New York City.”

He added that this plan could change over time.

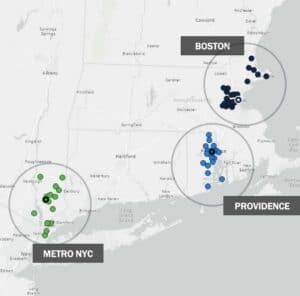

Brookline Bancorp’s footprint will expand just outside New York City. Image from Brookline Bancorp investor presentation.

The acquisition will give Brookline Bancorp over $10 billion in assets. Brookline Bancorp’s co-president and chief financial officer, Carl Carlson, said during the call that the bank expects $1.5 million annualized in costs beginning in the second half of 2023 for reaching that threshold. Carlson said in response to an analyst’s question that $1.1 million would come from lower interchange fees, which are required on debit card transactions for banks over that threshold as part of the Durbin Amendment to the Dodd Frank Act. The rest involved increased regulatory costs.

Brookline Bancorp expects 30 percent in cost savings from the acquisition, with a 7.5 percent dilution in tangible book value. The bank expects to earn that back in 3.6 years.

PCSB Bank – once known as Putnam County Savings Bank – was founded in 1871 and converted from a mutual to a stock bank in 2017.

Under the terms of the merger agreement, PCSB stockholders will receive either $22 in cash consideration or 1.3284 shares of Brookline common stock for each share of PCSB common stock. The deal is subject to allocation procedures to ensure 60 percent of the outstanding shares of PCSB common stock will be converted to Brookline common stock, Brookline Bancorp said in a statement Tuesday.

Michael Goldrick, PCSB Bank’s executive vice president and chief lending officer, will become PCSB Bank’s president and CEO after the deal closes. Perrault will join PCSB Bank’s board, and one of PCSB Bank’s directors will join Brookline Bancorp’s board.

Perrault told an analyst that he was not looking for another bank in a geographic location, including Connecticut, that would link the Rhode Island and Hudson Valley markets, noting that Brookline Bancorp was specialized in various commercial banking activities and was not a big consumer bank.

“In between our banks and this one are some not-interesting and some interesting markets,” Perrault said. “I would rather try to replicate what we have in an attractive net new market rather than try to cover the waterfront, because that’s not our bailiwick, that’s not how we do this.”

|

|