It looks like Greater Boston’s red hot housing market still has some juice left, but just how much remains to be seen.

After a fall-off last year raised some red flags, construction of badly needed new homes, condominiums and apartments across Massachusetts is on the rebound once again.

That said, we might be looking at the last hurrah for a real estate market recovery that is headed towards the decade mark. In particular, soaring construction costs and overbuilding of luxury apartments threaten to snuff out the erstwhile recovery in new construction. But for the moment the numbers are once again moving in the right direction.

Residential construction is up 21 percent across Massachusetts during the first six months of 2017 compared to the same period a year ago, U.S. Census Bureau stats show.

Local cities and towns across the state have awarded building permits for 8,158 new homes, apartments and condos through the end of June. The numbers are roughly equally split between single-family homes and multifamily units. That’s compared to 6,728 building permits doled out during the first six months of 2016.

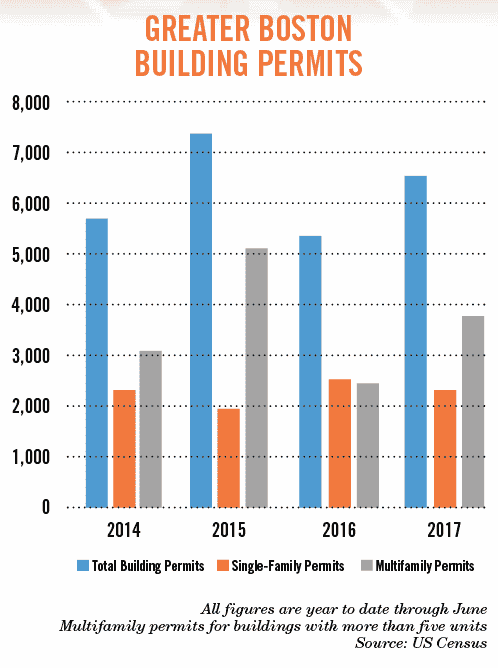

The rebound we’ve seen so far this year gets us back to 2015 levels of construction, or roughly where we were before last year’s downturn.

Leading the way have been not just new tower and residential buildings in Boston, but also apartment and condo projects in the suburbs, including along 495 in booming Marlborough and even down in Plainville along the Rhode Island border.

“I do agree there is an uptick in housing starts,” John Smolak, a real estate development attorney and board member of the Massachusetts Association of Home Builders. “Within the Route 128 belt, the market continues to be extremely strong, and there is definitely an increase in activity around the Route 495 area both north and south, but particularly stronger south of Route 495.”

Too Much Of A Good Thing

Still, the lion’s share of new residential construction in Massachusetts continues to take place in Greater Boston, that sprawling territory ranging from the Boston’s waterfront in the east to the outer burbs along 495.

The number of building permits issued in Greater Boston jumped 22 percent in the first six months of 2017, rising to 6,619. That is roughly three-quarters of all the new residential construction activity in the state.

Yet while the numbers have bounced back, whether they can continue at the current pace or will begin to soften again over the next year or two remains to be seen.

The main danger right now to the housing market – and in particular, new construction – doesn’t at the moment come from any looming recession, though that can never be counted out. Rather, the biggest threat to rollout of new homes, apartment and condos comes from an increasingly overheated construction market.

Construction contractors and their subs are up to their ears in work, and not just building new apartments and condos. There’s also a tidal wave of new commercial construction as new office buildings, lab complexes and retail take shape. And if all that wasn’t enough, there’s the giant, $2.4 billion casino being built by Steve Wynn in Everett that is sucking up the services of thousands of local hard hats.

All that construction activity is sending labor costs through the roof and forcing contractors and developers to scramble to cut costs and raise prices – or some combination thereof – to keep projects rolling.

But for developers of new luxury apartment projects, raising rents may not be as easy an option as it once was, with a growing glut of gilded apartments taking away some of their pricing leverage. The combination of a flat market for luxury rents with soaring construction costs could delay or even derail some projects, pushing numbers down.

Already there are a growing number of developers either putting the brakes on new luxury apartment towers or opting to add or even switch to condos, said David Begelfer of NAIOP Massachusetts, which represents developers across the state.

Already there are a growing number of developers either putting the brakes on new luxury apartment towers or opting to add or even switch to condos, said David Begelfer of NAIOP Massachusetts, which represents developers across the state.

Unfortunately, developers have few options when dealing with construction costs, especially when it comes to labor.

What you see is what you get when it comes to the pool of skilled construction workers in Boston and its environs – it simply costs too much to live here to recruit construction workers from other major metro markets, Begelfer notes.

So while the rebound in new construction so far in 2017 is certainly welcome, it is premature to do much celebrating given the challenges ahead.

“I think our slowdown is going to come prior to the recession,” notes Begelfer. “Our slowdown will come first from good times.”

Simply put, Greater Boston’s housing market is in much more danger of flaring out right than suddenly going cold.

|

|