Economics 101 says increasing demand coupled with decreasing supply equals rising prices – and to the surprise of no one, the end of this trend in the Bay State’s real estate market is nowhere in sight.

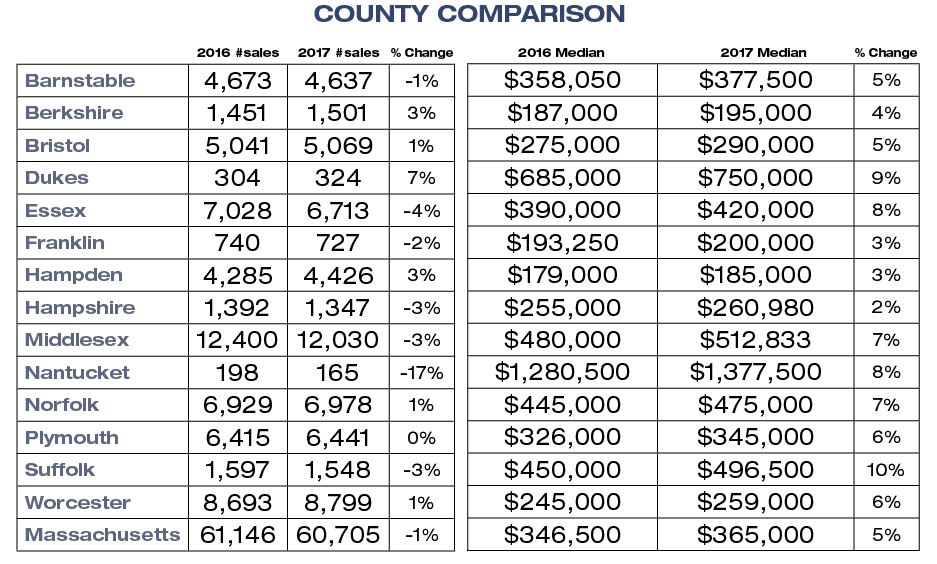

The median sale price in 2017 jumped 5 percent to $365,000, a new record high, according to recently released analysis from The Warren Group, publisher of Banker & Tradesman. The number of single-family homes sales dropped 1 percent year over year in the state – a difference of just 102 sales.

Without exception, everyone in real estate is talking about the lack of inventory. It’s been sinking for years – creating a lot of pent-up homebuyer demand – and is now at historic lows.

Barnstable County mirrored the statewide numbers with a 1 percent drop in the number of sales and a 5 percent increase in the median price, to $375,000. Buyer demand coupled with a strong second-home market and a strong economy are driving the market there, said Brewster-based Annie Blatz, immediate past president of the Massachusetts Association of Realtors and branch executive of several Kinlin Grover offices.

“I recently heard an economist say that with the stock market being so good, a lot of people with wealth will seek to diversify, cash out some of those gains and put them into real estate – and that sounds good to me,” she said. “There is always a demand for property on Cape Cod. Our biggest problem is inventory. We’ve seen an increase in listings in the first quarter, but they are selling so quickly, you don’t see a sustained increase. It will be a slow recovery for inventory.”

Blatz’s offices saw an increase in cash sales last year, which she attributes to rising home values across the state.

“When homeowners have a lot of equity in their off-Cape house, it increases demand for second homes on the Cape,” she said.

Pace of Growth Not Sustainable

Norfolk County beat the state’s numbers with a small increase in the number of sales (1 percent) and a median sale price that jumped 7 percent to $475,000. Plymouth County also outpaced the state, with essentially flat sales and a 6 percent increase in prices, bringing the median sale price there to $345,000.

“Right now prices are going up and we’re seeing our worst year in inventory,” said Rita Coffey, current MAR president and manager of Century 21 Tullish & Clancy, which operates in both counties. “That’s where it gets really frightening for us all. Demand is extremely high. Our open houses are getting 30 to 40 people in them and generate multiple offers. Of course, cash is king. First-time buyers are being pushed out of the market. Prices are up. Lenders tell us rates are going up. Where’s the affordability?”

The younger buyers working in Boston who were looking in Weymouth, Braintree and Quincy for the manageable commute are increasingly priced out of those markets, she said, and moving south to Plymouth. The lack of inventory combined with the scarcity of new homes means buyers everywhere are being pushed into more distant suburbs.

“We’re excited to hear [Gov. Charlie Baker] is addressing issues around housing production. We may see a little bit of movement there in the short-term,” Coffey said. “We’re not seeing a ton of listings come on right now. Agents are making phone calls and going door to door looking for listings.”

Worcester County also outperformed the state with a 1 percent increase in the number of sales and a 6 percent increase in the median sale price to $259,000. Like other counties, Worcester is attracting buyers priced out of communities around Boston, said Judy Patterson, president of the Central Massachusetts Association of Realtors.

“Boston prices drive buyers to Central Mass,” she said. “Plus, look at all the changes that are going on in Worcester, with projects like City Square and restaurants and hotels and the Hanover Theatre. Worcester has a lot to offer and the train is right there. A lot of people don’t have to go into the office every day, [so] that the long commute is not as much of a factor.”

Patterson thinks 2018 will be a little stronger and better than 2017, in part because buyers are noticing that interest rates are inching up and more of them are getting off the fence and into the market. She said she’s encouraged by the bidding wars she’s already seeing in December and January.

“My prediction is for prices and inventory to both increase a little bit,” Patterson said. “It’ll be a strong year. Last year was a good year, but it was also challenging. In April I had a first-time buyer in the $250,000 price range. We looked at 75 houses and wrote 10 offers before she got one accepted on a house in Worcester. She finally closed in October.”

Those seeking affordability will have to go a long way from the state’s economic hubs. Berkshire County had the lowest median sale price last year at $195,000, with Franklin County just a bit higher at $200,000. But if those buyers aren’t looking now, they should be – Berkshire saw a median increase of 4 percent year over year and Franklin an increase of 5 percent.