Industrial development is ramping up to the highest levels seen in the current real estate cycle, driven by a group of large speculative projects designed to satisfy shifting shopping patterns and the Massachusetts building industry’s demand for storage space.

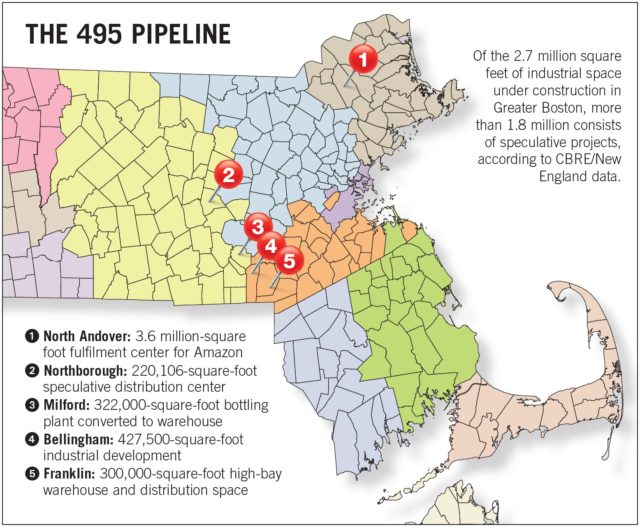

Colliers International is tracking nearly 15 million square feet of future industrial development at 45 properties in Greater Boston, including projects that are under construction and others still in permitting, such as Amazon’s proposed 3.6 million-square-foot fulfillment center in North Andover.

The demand is driven by multiple factors, said Dion Sorrentino, a research analyst at Colliers: e-commerce companies’ need for faster delivery options, industrial properties near Boston being redeveloped and displacing tenants to the suburbs, and warehouse space needed to serve the booming construction industry.

“Some tenants are being priced out of the urban market, and [Interstate] 495 has more affordability as more distribution companies are looking for last-mile space,” Sorrentino said. “We are seeing some multinational users stepping up their presence, and large regional companies looking for distribution space.”

Investment Focused on Exurbs

Most of the development activity is concentrated along the I-495 belt, offering highway connections to New Hampshire, Connecticut and densely populated areas of Greater Boston.

In Northborough, a 220,106-square-foot speculative distribution center at 301 Bartlett St. has had early leasing successes. Two tenants inked leases before its completion early this year: Maintenance Supply Headquarters, which carries supplies for the multifamily housing industry, and door and molding manufacturer Metrie. The complex has just 63,000 square feet still available, said Kevin Brawley, a Colliers vice president.

In Northborough, a 220,106-square-foot speculative distribution center at 301 Bartlett St. has had early leasing successes. Two tenants inked leases before its completion early this year: Maintenance Supply Headquarters, which carries supplies for the multifamily housing industry, and door and molding manufacturer Metrie. The complex has just 63,000 square feet still available, said Kevin Brawley, a Colliers vice president.

Companies new to the region such as Maintenance Supply Headquarters are looking for minimum 32-foot clear heights, one loading dock for each 5,000 to 7,000 square feet of building area and minimum 40-foot column spacing, Brawley said. Such specifications are hard to find in older buildings, driving the demand for new construction. And real estate developers are increasingly willing to build speculative warehouse and distribution space to meet those requirements.

Of the 2.7 million square feet of industrial space under construction in Greater Boston, more than 1.8 million consists of speculative projects, according to CBRE/New England data.

Braintree-based Campanelli Cos. and Clarion Partners are partnering on a 427,500–square–foot industrial development on Maple Street in Bellingham, where they leased the first 127,000-square-foot building this spring to 7-11 and pretzel manufacturer Snyder’s-Lance Inc.

In Milford, a former bottle manufacturing plant is being redeveloped into 322,000 square feet of warehouse space being marketed by Newmark Knight Frank. Industrial developer New Mill Capital acquired the property in December for $4.1 million from the previous owner-operator, Ardagh Group, and obtained $6.9 million in mortgage financing from Academy Bank. The space is being renovated with additional loading docks, parking and upgrades to warehouse and office space.

And in Franklin, CBRE is marketing 300,000 square feet of high-bay warehouse and distribution space scheduled for completion in September at 100 Financial Park. The building will feature 36- to 40-foot clear heights.

Finding Fulfillment at the Office Park

Dallas-based developer Hillwood’s planned redevelopment of the former Lucent Technologies campus in North Andover for a 3.6 million-square-foot Amazon warehouse is a shot in the arm for the 495 submarket. The vacancy rate in the 18.6-million-square-foot 495 North market was over 20 percent at the end of the first quarter, according to a Newmark Knight Frank research report.

Hillwood plans to buy 110 of the Osgood Landing property’s 168 acres from Ozzy Properties, demolishing a manufacturing building to make room for the Amazon fulfillment center.

Steve Adams

But industrial redevelopments are unlikely to be the saviors of many more outer suburban office parks, said Michael Ciummei, a senior vice president at JLL Boston.

“Amazon is somewhat of a special circumstance in that they are doing a multistory industrial building, and especially on 495, I don’t think you need to,” Ciummei said. “Single-story works fine and multistory is so expensive. Most of that is in other areas within a few miles of the city, so you can get in and out quickly.”

The Osgood Landing redevelopment is a potential model for select suburban sites, said Aaron Jodka, director of research at Colliers Boston.

“A lot of these sites have 20 to 80 acres of developable land that never came to fruition after the tech bust, and those could be candidates for industrial development as we continue to see more demand for last-mile distribution and next-day delivery.”

|

|