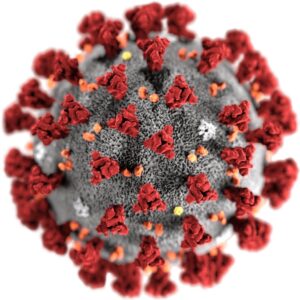

An illustration of the new coronavirus that causes the disease COVID-19. Image courtesy of the Centers for Disease Control.

The number of first-time unemployment aid claims crept up last week in both Massachusetts and nationwide compared to the prior week, hinting at ongoing volatility in the job market and continuing economic uncertainty more than four months into the pandemic. At the same time, the number of COVID-19 cases increased.

State labor officials reported receiving 19,179 new filings for jobless benefits between July 19 and July 25, an increase of 1,025 over the previous week. While the weekly sum was one of the lowest since the start of the crisis, it also marked only the second time since April in which total weekly applications were greater than the week before.

Applications for the expanded eligibility Pandemic Unemployment Assistance program also increased from 12,402 in the week that ended July 18 to 14,850 in the week that ended July 25.

The slight uptick in Massachusetts residents seeking unemployment aid comes with the state well into its third phase of a phased plan to revive business activity after months of forced shutdowns.

While many establishments have reopened to some degree, the lingering damage is profound. Massachusetts had the highest unemployment rate in the nation in June at 17.4 percent, and additional cuts to the public sector could be on the horizon if the federal government does not provide aid to close massive state and local budget gaps.

Federal figures showed a similar trend of rising unemployment applications. Americans filed 1.43 million initial claims for standard unemployment insurance last week, compared to 1.42 million one week earlier and 1.3 million two weeks earlier.

The statistics come as a new National Association of Realtors survey based on U.S. Census Bureau data from finds that only 68.1 Massachusetts residents who make less than $50,000 a year made last month’s mortgage payment, compared to 85.9 percent of those making $50,000 to $100,000 a year, 82.7 percent making between $100,000 and $150,000, 99.2 percent of those making $150,000 to $200,000 and 99.8 percent of those making $200,000 or more. Twenty-five percent of Massachusetts homeowners making less than $50,000 a year did not pay their mortgage and only 6.8 percent deferred, compared to 5.3 percent and 8.8 percent respectively for those making between $50,000 and $100,000 and 2.8 percent and 14.5 percent respectively for those making $100,000 to $150,000.

With upticks in positive COVID-19 testing rates linked to larger social events, Gov. Charlie Baker said Thursday that his administration is reviewing the state’s guidance on gathering sizes, but blamed the behavior of people choosing to party without precaution for the clusters of infections that have sprung up.

The state’s guidance instructs people to limit indoor gatherings to 25 people, and a maximum of 100 people outdoors depending on the size of the venue. The state’s positive test rate is at 2 percent currently, which is still low, but has been rising slightly over the past week or so.

A large party in Chatham has been linked to a cluster of new infections there, while a number of lifeguards who attended a party in Falmouth walked away infected by COVID-19. And on Nantucket, officials are considering scaling back restaurant hours as infection numbers on the island have ticked up and people have been observed gathering on beaches close to one another without masks.

“I think that’s one of the things we’re talking about,” Baker said at a press conference when asked about the state’s gathering size limits. “But the bigger issue is not so much the nature of the size of some of these gatherings, especially the private ones that are going on in backyards and places like that. The bigger issue is honestly the behavior generally at those, which is not socially distant, no masks and in some respects a lack of respect for how this virus works and how it moves from person to person.”

“To all our residents I can’t express this enough. Don’t be careless or complacent,” he added.

|

|